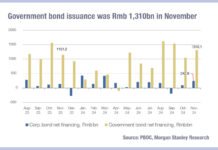

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...

KazMunayGas lists US$2.75 billion of Eurobonds on LSE

London Stock Exchange (LSE) has seen its largest issuance of corporate bonds from the CIS region since 2014. Kazakh oil and gas company, KazMunayGas,...

The time has come for digital adoption in the corporate bond markets

By David Nicol, CEO LedgerEdge.

The corporate bond market is critically important – it allows companies to raise capital, pension funds to meet obligations, and...

LedgerEdge goes live with eagerly anticipated bond trading platform

LedgerEdge, the distributed ledger ecosystem for trading bonds has gone live with a regulated corporate bond trading platform built using distributed ledger technology (DLT),...

FlexTrade integrates IHS Markit pre-trade TCA data into EMS

FlexTrade, the multi-asset execution and order management system provider, and IHS Markit, the analytics and solutions provider to buy- and sell-side firms, are integrating...

TABB Group shuts down

Larry Tabb, the eponymous founder of market anayst firm TABB Group, has announced the firm will close. Making the announcement via Twitter, he wrote:...

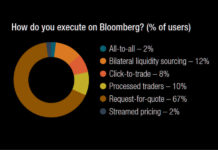

The DESK’s Trading Intentions Survey 2020 : Bloomberg

Bloomberg has a strong position as data provider, interface into the market and a trading venue.

The ubiquitous terminal allows it to build new services...

Federated Hermes trades “less than 5%” on e-trading platforms

The chief investment officer (CIO) of asset manager Federated Hermes investments (FHI), which has US$758 billion in assets under management, has said the firm...

Trading desk efficiency benchmark 2016

This primary research offers traders a view of trading operations within their peer group, to benchmark against their own.

This research is a snapshot of...

FCA to investigate barriers for buy side to access data

The UK’s market regulator, the Financial Conduct Authority (FCA) will launch two market studies and gather further information to investigate access to wholesale data....

Five dealers select Droit for MiFID II Compliance

By Flora McFarlane.

BNP Paribas, Crédit Agricole CIB, Goldman Sachs, Lloyds and UBS are using Droit Financial Technologies for MiFID II trade compliance infrastructure.

Jo Hannaford,...

The hidden liquidity in IBHY and IBIG futures

Real-money asset managers are finding that Cboe’s cash-settled corporate bond index futures – IBHY and IBIG futures – allow them to track ETFs in...