First quarter sees Tradeweb break US$1 trillion ADV

Market operator Tradeweb saw a US$1.06 trillion record average daily volume (ADV) for the first quarter of 2021, an increase of 18% compared to...

Schroders’ former head traders return to senior roles

Rob McGrath, former global head of trading at Schroders, and Nick Robinson, former head of trading for Fixed Income and Active FX at Schroders,...

TransFICC: Technology in the spotlight

RFQ growth and DORA compel firms to focus on system capacity, high performance, complex workflow automation, and disaster recovery (DR).

The fixed income market structure...

CGS-CIMB Securities adopts Bloomberg TOMS and data licence for expansion

Asia-based financial services provider, CGS-CIMB Securities International, has adopted Bloomberg’s Trade Order Management System (TOMS) and data via Bloomberg Data License (DL) to scale...

BlueCrest hit by £40m fine by FCA

Fund manager BlueCrest has been fined just over £40 million by the UK’s Financial Conduct Authority (FCA) for inadequate disclosures to investors, regarding its...

TransFICC investment to deliver e-trading platform with trader desktop

TransFICC, the specialist provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has closed a Series A extension for US$17...

Row erupts as CBOE seeks to define exchange boundaries

An application by multi-asset market operator, CBOE, to define what is considered a ‘facility’ of the exchange, has triggered a row. The firm sought...

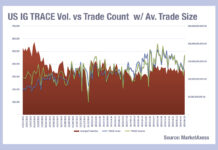

Upping strike rate and strength in US IG

We often hear ‘nothing really changes’ in relation to capital markets so it is good to have an insight into real progress, courtesy of...

ICE: Creating clarity in the MBS market through better data

The highly fragmented nature of mortgage asset components has historically translated into a lack of granular data for investors. Intercontinental Exchange (ICE) aims to...

MarketAxess Q2 update: Claims 20% share global credit trading; portfolio trading ‘flattened out’

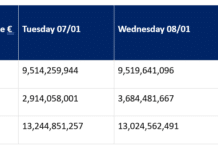

MarketAxess has reported its Q2 results for 2022, including a record composite corporate bond market share, estimated at estimated 20.2%, up from 17.8% in Q1 2021...

Tipping Point: CME’s SOFR-linked STIR Futures eclipse Libor-linked STIR Futures for first time

CME open interest data confirms that Secured Overnight Financing Rate (SOFR)-linked short term interest rate (STIR) Futures open interest has, for the first time,...

IHS Markit partners with Adroit to deliver multi-asset execution via thinkFolio

Investment services, risk and data management giant, IHS Markit, has partnered with Adroit Trading Technologies to give access to its multi-asset execution management capabilities...