Parameta Solutions becomes an authorised benchmark administrator

Parameta Solutions, the Data & Analytics division of TP ICAP, has become a Financial Conduct Authority (FCA) authorised benchmark administrator, which it claims makes...

TSE and Tradeweb respond to investor ETF demand

Tradeweb has connected to the Tokyo Stock Exchange’s (TSE) request-for-quote (RFQ) platform Conneqtor as demand for ETFs jumps up by a third in Asia....

White paper: Is bond trading on the cusp of a change?

A white paper published by Flow Traders and WBR Research* has identified several key indicators that execution quality is being enhanced by new ways...

Primary markets: Give me some credit: Outlook for bond issuance in 2023

New issues provide liquidity and price points for bond traders; we assess the prospects for the year ahead.

As the cost of borrowing continues to...

EM stabilising could encourage market makers

Emerging market activity has seen a reduction in volatility in the first half of the year, with both volumes and pricing levels falling slightly,...

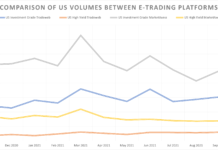

How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...

Trumid: Portfolio trading comes of age

For an institutional investment manager that needs to add or reduce risk in its corporate bond portfolio, being able to trade a custom basket...

Neptune adds MUFG to its network

By Flora McFarlane.

Neptune has announced that MUFG (Mitsubishi UFJ Financial Group) is the latest bank to join its fixed income network, bringing the total number...

Mosaic Smart Data appoints Oxford Professor as Scientific Advisor

Rama Cont, Professor of Mathematical Finance, joins as Scientific Advisor

London, June 2019: Mosaic Smart Data (Mosaic), the real-time capital markets data analytics company, has...

MarketAxess rides all-to-all and volume growth to record revenues in Q1

Bond market operator MarketAxess has reported Q1 2021 revenues of US$195.5 million, up 16% on the previous year and a company record. While Q1...

November sees e-trading volumes up

The 2020 pandemic marked a critical turning point for electronic trading in the corporate bond markets according to Tradeweb in the firm’s 2021 letter...

FILS 2024: Applying AI to trading

Asset management and trading businesses are being transformed by artificial intelligence. That was the message from a series of panels at the Fixed Income...