New patterns in Eurobond electronic trading after MiFID II

By Gherardo Lenti Capoduri, Head of Market HUB and Umberto Menconi, Business Development & Market Structure, Market HUB, Banca IMI.

We have come a long...

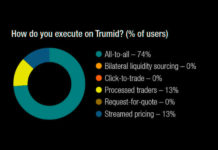

The DESK’s Trading Intentions Survey 2020 : Trumid

TRUMID

Trumid has experienced astounding growth over the past year, with average daily trading volume in January up 325% over January 2019, reaching US$761m, which...

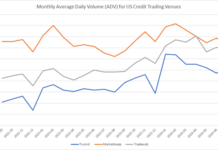

Dogfight in credit e-trading as platforms see double figure growth

Average daily volumes (ADV) for Tradeweb’s cash rates trading were US$455 billion for the month of July, the company reported, with overall government bond...

MeTheMoneyShow : Brexit Schmexit and a passing of the old guard

In this podcast Dan Barnes speaks with Lynn Strongin Dodds on how the USA is winning derivatives business from the UK - to the...

Berry named global head of trading at Refinitiv

Dean Berry has joined data and benchmarking giant Refinitiv as global head of trading. Berry was most recently the global head of electronic and...

Trumid collaborating with Jefferies in EM credit trading

Bond market operator, Trumid, is collaborating with Jefferies in emerging markets (EM) credit trading.

Jefferies will use Trumid’s Attributed Trading (AT) protocol and workflow solutions...

Tradeweb expands mortgage trading platform to originators

Fixed income market operator, Tradeweb, has expanded its platform for trading specified pools of mortgages, now enabling mortgage originators to trade alongside other secondary...

Greenwich: Data analytics now more valued than market structure knowledge

Three out of four capital markets professionals say data analysis will be the most valued skill on trading desks over the next five years,...

Primary markets see gradual progress as Investor Access reaches 600 buy-side users

A quick straw poll of buy-side traders suggests most believe the electronification of primary markets has stalled somewhat, with twice as many seeing progress...

Allegra Berman to leave HSBC

Allegra Berman will leave HSBC at the end of September, according to an internal memo seen by The DESK.

Berman joined the firm in 2013,...

ISDA has named Jeroen Krens as board chair

The International Swaps and Derivatives Association (ISDA) has appointed Jeroen Krens as its new board chair, effective 1st of January 2025. He succeeds Eric...

Is there value in fixed income TCA?

New research published by investment bank Barclays has suggested there is a limited use of transaction cost analysis (TCA) tools for purposes beyond regulatory...