9Fin takes the win in Dragon’s Den

Financial technology (fintech) firm 9Fin won the ‘Dragon’s Den’ event at FILS 2019, beating tough competition from Auquan and Scorable.

Following a series of pitches...

E-trading ‘outpaced’ voice for some traders in liquidity crisis

The market has evolved valuable alternatives to traditional dealer liquidity.

Electronic trading was tested in the March 2020 sell-off, and it held up well. But, most...

Overbond, SS&C Eze partner to provide AI bond trading analytics

Overbond, a provider of AI-driven data and analytics and trade automation solutions for the global fixed income markets, has partnered with SS&C Eze to...

TP ICAP connects dealers to Liquidnet’s New Issue Trading protocol

TP ICAP, the interdealer broker, market infrastructure and information provider, is enabling dealers to join the buy-side in placing orders and trade directly on...

Little consensus on impact of more clearing in US Treasuries

ISDA has published the results of a survey on the US Treasury market, which provides views on the potential benefits and costs of increased...

Data: A blank tape

Europe’s consolidated tape proposal is a start, but many details still need to be filled in for its value to be assessed. Lynn Strongin...

Project Amber: Dealer consortium developing new bond trading venue

A consortium of sell-side firms is developing a trading platform in the fixed income space, which could rival existing venues including Bloomberg, MarketAxess and...

Tradeweb sees volume drop in June

Bond market operator, Tradeweb, has reported its average daily volume (ADV) in June was US$780.9 billion (bn), a decrease of 8.9% year-on-year (YoY), largely...

SIFMA finds support for shift in benchmarking of 20-year US corporate bonds

The spread for many legacy 20-year US corporate bonds is benchmarked against the 30-year Treasury, but trade body SIFMA has found support for moving...

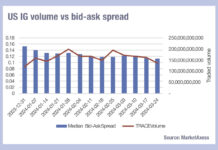

Volumes drop off as Q1 ends, but liquidity still cheap

A broad decline of trading volumes across European & US corporate bond and emerging market debt trading coincided with end of the first quarter...

Exclusive: What do buy-side traders think about Citadel’s entry into credit?

We asked senior buy-side trading heads about electronic market maker, Citadel Securities, entry into the corporate bond market as a direct market maker, a...

Does the value-add of data justify the cost to bond traders?

A new report from analyst firm Aite-Novartica has found nearly a third of bond market participants and traders believe it is hard to justify...