Vive la revolution!

Securing the benefits of the markets’ democratic revolution.

By Mike du Plessis, Managing Director, Global Head FX, Rates and Credit Execution Services and Mark Goodman,...

Eric Morrow joins Apollo Global Management

Eric Morrow has been named chief operations officer (COO) of trading at Apollo Global Management, an asset manager with US$550 billion of assets under...

Origination: State Street issues US$2.25 billion in senior debt

State Street has issued US$2.25 billion in senior debt through State Street Bank and Trust. The bank has partnered with diverse and veteran-owned firms...

European Women in Finance : Sarah Gordon : Making an impact

Senior writer Shanny Basar spoke to Sarah Gordon, CEO of Impact Investing Institute about how impact investing can contribute to the well-being of people...

Key trends in OTC derivatives markets

ISDA:

ISDA: Key Trends in the Size and Composition of OTC Derivatives Markets in the Second Half of 2023

Fixed income ETFs struggling with liquidity crisis

Fixed income exchange traded funds (ETFs) are reportedly struggling in the current liquidity crisis, while their market makers are trying hard to get delta...

thinkFolio integrates Investor Access to support primary market workflow

IHS Markit's thinkFolio investment management platform has integrated with the firm's Investor Access primary market workflow tool, to provide fixed income issuance support within...

CME to launch corporate bonds and MBS on BrokerTec Quote

CME Group will launch repo on corporate bonds and mortgage-backed securities (MBS) on BrokerTec Quote, the firm’s dealer-to-client (D2C) request-for-quote (RFQ) trading platform. US...

Uncertainty persists around process trades

A standardised approach to handling process trades would better support dealers. By David Wigan.

In mid-February, the European Securities Market Association (ESMA) published a formal...

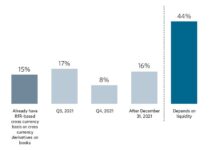

Bloomberg/PRMIA report finds liquidity barrier to RFR derivatives use

A new report by the Professional Risk Managers' International Association (PRMIA) and Bloomberg has found that while the majority (79%) of the firms with...

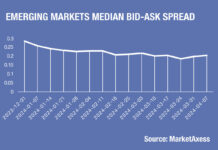

Bid-ask spreads drop 25% on average in many markets

The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year,...

Focus on China’s property sector

The charts we focus on this week are from CreditSights, and look at the issuance and outstanding bonds for Evergrande, the Chinese property developer...