The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

Buy-side firms may dominate front office tech

Buy-side firms need to make secular decisions about whether to buy or sell technology to other asset managers. Dan Barnes reports.

In April, CEO of...

Is this the new era for electronic credit trading?

By Iseult E.A. Conlin, CFA., Managing Director, U.S. Cash Credit, Tradeweb.

Digital transformation is happening in industries all over the world. Whether it’s video streaming services disintermediating...

AM Best adjusts credit ratings and outlooks

AM Best has assigned and upgraded the credit ratings of a number of firms, reflecting changes to elements including balance sheets, operating performance and...

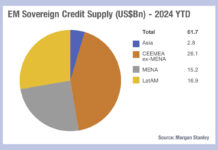

Morgan Stanley: EM issuance in 2024 to outstrip 2023

Assessment from Morgan Stanley has found sovereign hard currency gross issuance is likely to increase to US$164 billion in 2024 due to more open...

Bond trading boosts BNP Paribas’s FICC revenues

BNP Paribas’s investment bank delivered double digit revenue growth in 2019, with revenues for Fixed Income Currencies and Commodities (FICC) up by over 30%....

Matthew Walters joins Susquehanna

Susquehanna has appointed Matthew Walters as head of credit platform sales, a source has revealed to The DESK. He reports to Justin Lada, head...

LSEG names Charlie Walker London Stock Exchange deputy CEO

The London Stock Exchange Group (LSEG) has named Charlie Walker as deputy CEO of the London Stock Exchange (LSE).

Walker, who will also join the...

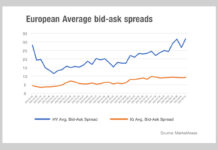

Is a liquidity crisis brewing in European HY?

Concern around liquidity in Europe’s high yield market has been rising over the past quarter as it is hit by a double whammy, falling...

Me the Money Show – Episode One

In this pilot episode, Markets Media Group editors Dan Barnes and Terry Flanagan discuss current conditions in institutional capital markets. Topics covered include how...

FILS USA: The significance of portfolio trading breaking 10% volume

Record sized portfolio trades (PT) were reportedly responsible for pushing PT volumes up to around 10% of US credit market average daily volume in...

Buy side hails positive development of STP for bond issuance

Risk warning lights flashing on buy-side trading desks could be assuaged thanks to industry collaboration on primary markets.

It seems incongruous that the 50-year old...