Concannon to take the reins at MarketAxess

Market operator, MarketAxess, will see current CEO and chairman Rick McVey become executive chairman from 3 April 2023 as Chris Concannon, currently president and...

Derivatives: Credit default swaps – The revival

Applying innovation from corporate bond markets to credit derivatives trading could boost liquidity at a point of market stress.

Single-name credit default swaps (CDSs) provide...

7 Chord to integrate Glimpse Markets’ bond transaction data

7 Chord, an independent provider of predictive prices and analytics to fixed income traders, issuers, and investors, has become the first AI pricing vendor...

Finsight acquires Credit Flow Research

Capital markets technology and market data firm Finsight has expanded its US fixed income market provision with the acquisition of Credit Flow Research.

The acquisition...

Swinburne: Traders should beware of radical change in Europe

Brexit will mean that politics will take precedent over principal, when setting policy in Europe, warned Kay Swinburne MEP, speaking at the Fixed Income...

Primary markets start 2023 with top ten hit

Bond issuance for US investment grade on 3 January 2023 was the tenth largest day on record, according to data from Dealogic.

While January is...

Barclays Bank adopts CLS’s CCS service

Barclays Bank has gone live on CLS’s cross currency swaps (CCS) service.

The CCS service, an extension of the CLSSettlement payment-versus-payment settlement solution, mitigates settlement...

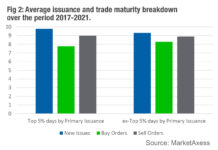

New issuance drives up secondary selling

News that high yield (HY) issuance has fallen in Europe may be of little consolation to investment grade investors, as new data from MarketAxess...

Clearstream consortium seeks to resolve historic Reg S and Rule 144A bond inefficiencies

In October, the international central securities depositary (ICSD), Clearstream, has its seventh meeting of its business consortium to reduce operational risks and time delays...

The Book: Clearwater Analytics releases commercial paper issuance tool

Clearwater Analytics has released a commercial paper (CP) issuance tool, aiming to improve firms’ efficiency by providing a real-time view of issuances.

With the goal...

Swap market participants begin using DSB

It appears that swap market participants are beginning to use the service in increasing numbers as the Derivatives Service Bureau (DSB) reports a rise in...

SGX CDP live with Marketnode DLT direct-to-depository service for bond issuers

Singapore Exchange’s Central Depository (SGX CDP) has made a blockchain-enabled bond issuance platform available to market participants. Developed by Marketnode, an SGX Group-Temasek digital...