Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Rules and Ratings: EU associations call for credit rating-led bond transparency

AFME, the German Investment Funds Association (BVI), Bundesverband der Wertpapierfirmen (bwf), EFAMA and ICMA have encouraged the EU to calibrate corporate bond transparency regimes...

AFME report on rates trading suggests enhanced transparency could boost liquidity

A report by the Association of Financial Markets in Europe, and investment data management provider, Finbourne, has found enhanced transparency could potentially boost liquidity...

Row erupts as CBOE seeks to define exchange boundaries

An application by multi-asset market operator, CBOE, to define what is considered a ‘facility’ of the exchange, has triggered a row. The firm sought...

Lynn Challenger: Riding out historical volatility

UBS AM’s trading team is designed to engage by choice, not necessity, allowing it to move in heavily directional markets for the advantage of...

Tradeweb see US credit volumes jump while European credit falls

Market operator Tradeweb has reported overall trading volumes of USUS$23.4 trillion in August 2022, with average daily volume (ADV) for the month across assets...

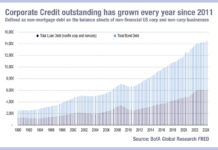

Refinancing debt: New bonds, old problem

A new paper from Bank of America’s credit strategist Neha Khoda and Adam Vogel has found that bond issuers are facing a significant increase in costs...

BMO to redeem Series J Medium-Term Notes

The Bank of Montreal (BMO) has announced its intention to redeem all its US$1,000,000,000 Series J Medium-Term Notes (Non-Viability Contingent Capital (NVCC)) (Subordinated Indebtedness)...

Fed’s Treasury Market Practices Group sheds light on March liquidity crisis

Minutes of the 31 March meeting of the Federal Reserve’s Treasury Market Practices Group (TMPG), including an update on a 19 March call between...

Securitisation veteran jumps to Piper Sandler

Piper Sandler has appointed Mary Stone as managing director and co-head of the structured finance group.

Based in New York, she shares the role with...

The Book: Clearwater Analytics releases commercial paper issuance tool

Clearwater Analytics has released a commercial paper (CP) issuance tool, aiming to improve firms’ efficiency by providing a real-time view of issuances.

With the goal...

BoE sets code of conduct for repo and securities lending

A new voluntary Money Markets Code setting out the standards and best practice expected from participants in the deposit, repo and securities lending markets...