Top tips from TradeTech: Connect debt, derivatives and equity trading

Buy-side traders have observed that close ties in the trading team based on the targets on an investment – be that corporate or government...

FILS in Barcelona: The modernisation of the bond market

A massive modernisation of the bond market is being recognised at the Fixed Income Leaders’ Summit in Barcelona.

Although the event was largely held...

Month-end activity in alternative protocols

By Misha Girshfeld, Research Specialist and Grant Lowensohn, Senior Research Analyst at MarketAxess. 25 October, 2022

Highlights

We have seen an average increase of about 11%...

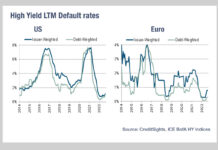

Less distressed debt

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

Electronification of US credit delivers resilience

The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it...

ICE: Size-Adjusted Pricing (SAP)

Shifting odd lot dynamics throw a spotlight on ICE’s Size-Adjusted Pricing

A dramatic jump in small trade volumes, driven by increased retail and electronic...

ESMA corrects SI bond ranking to place BNP Paribas as second in Europe

The European Securities and Markets Authority (ESMA) has republished its ESMA Annual Statistical Report, now stating that the largest systematic internalisers (SIs) for bond...

The Book: Primary dealer positions climb rapidly, but concerns appear unfounded

Primary dealer positions of US Treasury holdings are expanding rapidly, but concern around restrictions on capacity are misplaced according to analysis.

A new paper by...

The effect of war on pricing and spreads is widening

The economic effect of the Russian invasion of Ukraine needs to be put in context next to the human tragedy, but data is showing...

Bond market growth slumped in 2018

By Pia Hecher.

Intercontinental Exchange (ICE) Data Indices, the information provider, has reported that the total outstanding debt across global bond markets only grew by...

Sterling dealers recommend SONIA as alternative to LIBOR

The Bank of England’s Working Group on Sterling Risk-Free Reference Rates – a group of major dealers active in sterling interest rate swap markets – has...

Big names out at BGC

Interdealer broker BGC Partners has made a wave of job cuts, as announced in April, which combined with recent departures has removed several heads...