High yield bond issuance relative to liquidity

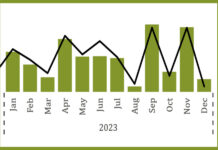

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023...

Portfolio trading challenged on best execution

For decades, tourists have flocked to Spain’s Costa Brava in anticipation of the three Ss, broadly understood to refer to sun, sea and sangria....

Electronic trading volume in US fixed income hits record

Electronic trading of US investment-grade and high-yield bonds reached an all-time high in July according to data from Coalition Greenwich.

Overall electronic trading accounted for...

Vela hooks up with Fenics UST to support low-touch trading

Execution technology supplier, Vela, has added Fenics US Treasuries (Fenics UST), the electronic Treasury trading platform owned and operated by BGC Financial, to its...

Bloomberg facilitates European government bonds electronic list trade

Bloomberg has executed the first electronic list trade in European government bonds though its multilateral trading facility (MTF), with its evaluated pricing service (BVAL)...

OpenDoor reveals greatest challenge and a turbo-charged match rate

OpenDoor has revealed a significantly high match rate for asset managers on the all-to-all continuous order book it launched in January 2020, to replace...

ICMA says execution and order management systems are not trading venues

The International Capital Markets Association (ICMA) has responded to the European Securities and Market Authority (ESMA) consultation into the ‘trading venue perimeter’ by arguing...

Glue42 aims to boost buy and sell-side internal collaboration

Glue42, the desktop tools integration specialist, has released a new version of its open-source platform, Glue42 Core. The new release, version 2.0, is designed...

Jacques Aigrain and Rana Yared join Tradeweb; June volumes up 18% YoY

Multi-asset market operator Tradeweb Markets has appointed Jacques Aigrain and Rana Yared as independent directors, effective 1 August 2022. Aigrain will chair the Compensation...

Neptune providing real-time bond inventory data to Charles River

Charles River Development and Neptune Networks are collaborating to provide buy-side clients of Charles River’s Order and Execution Management System (OEMS) with aggregated, real-time...

Review of 2023 Trading: Trade sizes falling – in parts…

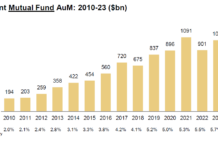

Looking back at this year’s trading activity, through analysis of MarketAxess Trax data and TRACE for US markets, we can see clear patterns emerging...

How big can systematic trading get in credit?

Investors can achieve significant advantages though systematic trading, such as reduction of trader/investor bias, and responsiveness to signals. However, there are limits to the...