The DESK’s Trading Intentions Survey 2021 : Neptune

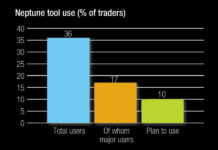

Neptune has expanded its user base to 36% of buy-side traders in 2021 up from 29% in 2020, a considerable increase and one that...

Viewpoint: Mike Googe & Ravi Sawhney, Bloomberg

Fixed income TCA: The state of the art.

Scratching the surface of buy-side transaction cost analysis use reveals demand for very tailored metrics, as Mike...

Rules & Ratings: FTSE Russell launches Fixed Income TPI Index and TPI Focused Glidepath...

FTSE Russell has rolled out two new indices – the FTSE Fixed Income TPI Climate Transition Index Series and the FTSE Fixed Income TPI...

Bloomberg machine learning pricing solution enhances fixed income trading visibility

Bloomberg’s Intraday BVAL (IBVAL) Front Office is now available to Bloomberg Terminal customers, as well as users of Bloomberg’s real-time streaming market data feed,...

Government & municipal bonds | Investor paradox | Dan Barnes

SWIMMING WITH GOVERNMENTS.

Government agencies are issuers, rival investors, market regulators and controllers of interest rates; how do asset managers handle them? Dan Barnes writes.

Central...

ICE Bonds receives approval for expansion in Canada

Intercontinental Exchange (ICE), the market operator and data/technology provider has received approval to operate its ICE TMC fixed income trading platform in all Canadian...

European Markets Choice Awards Winner: Charles River

The Evolving Fixed Income Trading Landscape: Leveraging Connectivity, Interoperability and Automation

Alun Cutler, Director, Product Management, EMEA at Charles River Development

Charles River has recently been...

Trading for Trees: Giving back through trading green bonds

Since its inception, the MarketAxess “Trading for Trees” initiative has helped to plant over 385,000 trees across a range of biodiversity, climate stability and...

US Treasury volumes up, volatility down post-election

Average daily notional volume (ADNV) in US rates trading rose by 14% year-on-year (YoY) in November, reaching US$953 billion. This marks the most electronic...

The liquidity bears’ picnic

If you are on the desk, there is often an inverse relationship between the tension you experience and the volume of people relaxing on...

Katana launches major product upgrade

AI investment and trading tool, Katana, has launched several new features including a secure watchlist, improved position-monitoring capabilities and refinements to its machine learning...

Credit Index Futures: Increasing price transparency, liquidity and capital efficiency to credit markets

Davide Masi, fixed income and currencies product manager, and Vassily Pascalis, senior vice president, fixed income sales at Eurex, discuss developing the asset class...