Independent review finds no evidence of financial misconduct at CPIPG

Claims of financial misconduct made against CPI Property Group (CPIPG) by investment firm Muddy Waters, first raised in November 2023, have no evidence, an...

Bond funds hit by massive fee discounts; active revenues predicted to fall

Bond funds are dropping their investment management fees by up to 37% - in the case of passive funds – from those of the...

Tradeweb poaches Daniel Swaby from Trumid

Tradeweb, a fixed income, derivatives and ETF electronic trading platform, has hired Daniel Swaby as director.

Swaby, formerly at Trumid where he worked in emerging...

Buy side calls for reform in US Treasuries

Treasuries market under the spotlight as US finance ministry takes stock in one of the most sweeping reviews of its kind. Anna Reitman reports.

The...

FCA rules out wholesale market data action despite higher price drivers

The UK’s Financial Conduct Authority (FCA) has published the findings of its wholesale data market study – ruling out any “significant intervention” on the...

7 Chord to integrate Glimpse Markets’ bond transaction data

7 Chord, an independent provider of predictive prices and analytics to fixed income traders, issuers, and investors, has become the first AI pricing vendor...

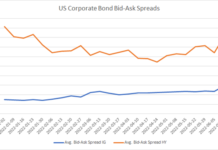

Falling costs of liquidity not halted by summer vol

The bid-ask spread for corporate bond markets has continued on a downward trajectory in September, after a bump in August, according to data from...

Credit : Back for good : David Wigan

Cautious optimism on Dodd Frank roll-back.

The US regulatory response to the financial crisis has shifted trading risk from sell-side to buy-side desks, making reform welcome....

TMPG meets to discuss key challenges in the Treasury market structure

The Treasury Market Practices Group (TMPG), an industry roundtable coordinated by the US Federal Reserve (The Fed) met on Tuesday 19 October to discuss...

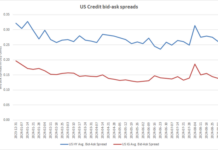

FILS USA 2022: Credit sees bid-ask spreads widen as volumes seesaw

Every trader attending FILS will be keeping an eye on the markets, as bid-ask spreads continue to tick upwards and volumes remain choppy.

Looking at...

FILS 2022: How ‘Giltmageddon’ could hit LDI specialists and drive new regulation

Traders at the Fixed Income Leaders Summits (FILS) largely reported that bond markets were quiet this week, with high yield and emerging bond markets...

SEC report on algo trading highlights lack of joint oversight

US markets regulator the Securities and Exchange Commission (SEC) has published a report to the US Congress on algorithmic trading in US debt and...