‘Flash Boys’ hits US treasuries market

An old-fashioned trading model is giving HFT firms the edge over dealers and funds on the interdealer treasury markets, writes Dan Barnes.

A number of...

FILS USA: The roadblocks to electronic fixed income trading

Fixed income markets moving toward electronic trading has been a recurring theme in the industry for a number of year, but there are roadblocks...

Bloomberg finds global bond deals down in Q3

By Shobha Prabhu-Naik.

Bloomberg, the global financial data provider, has published its League Table reports for the third quarter of 2018 showing that the global...

Lynn Challenger: Riding out historical volatility

UBS AM’s trading team is designed to engage by choice, not necessity, allowing it to move in heavily directional markets for the advantage of...

Report: Buy-side traders often still seen as ‘trading support’

A new report by Liquidnet entitled ‘Unbundling Best Execution: What do traders need to know?’ has found that while most buy-side trading desks are...

Credit Indices – Closing the Fixed Income Evolutionary Gap

Fixed income markets are evolving at pace, with smarter electronic trading protocols, more sophisticated, automated investment strategies and a greater availability of useful data.

In...

FILS USA 2023: Fed has lost investors’ confidence in guidance

The Federal Reserve’s constant mistakes on forward guidance have lost the confidence of some buy-side firms in its ability to predict outlooks.

Speaking at...

IHS Markit and CBPC open up China’s bond market with new onshore indices

By Shobha Prabhu-Naik.

Business information provider IHS Markit has launched new onshore Chinese bond market indices, which it claims are the first international, independent fixed...

David Fellah joins Broadridge

Expanding its AI and data division, Broadridge has appointed David Fellah as the firm’s first vice president of AI trading solutions. Based in New...

FILS 2024: Multifaceted monster or tamed by technology? Views on liquidity

According to the buy-side, liquidity no longer meets the old textbook definition – the ability to buy or sell, at a given price, size...

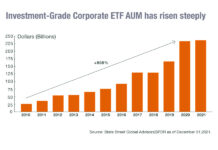

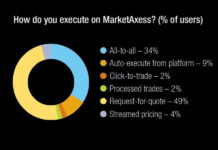

The DESK’s Trading Intentions Survey 2021 : MarketAxess

Consistently rated as the most effective platform for finding liquidity in the corporate bond market, MarketAxess has frequently been ahead of the market in...

A practical guide to buyside automation in credit markets

Gareth Coltman, Head of European Product at MarketAxess, looks at how automating buyside trade execution works in real life, and why it should be...