CME, DTCC boost cross-margining services

DTCC and CME Group have expanded their cross-margining initiative for clients of CME and the Government Securities Division (GSD) of DTCC's Fixed Income Clearing...

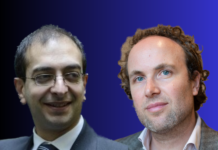

Disruption without interruption

David Parker, Head of MTS Markets International (MMI) discusses tapping into the benefits of fixed income trading technology.

Technological advancements are quietly – and sometimes...

LSEG extends Yield Book partnership for analytics with Citi

LSEG (London Stock Exchange Group) has announced an extension to its long-standing Yield Book analytics partnership with Citi.

Yield Book and Citi have a long...

Case study: Russell Investments in Search of Liquidity – Open Trading

As a top provider of Execution and Transition Management Service, Russell Investments understands the importance of leveraging cutting-edge tools for best execution.

Read more...

MarketAxess reports record revenue in 2021

Bond market operator MarketAxess saw total revenues for 2021 increase 1.4% to a record US$699 million, compared to US$689.1 million for 2020. Operating income...

Credit Suisse unveils transformation plan for investment bank as Meissner exits

Credit Suisse has said it intends to take “decisive steps” to restructure its investment bank and focus on areas more closely connected to its...

What is best execution and how can firms achieve it?

Gareth Coltman, Head of European Product Management, MarketAxess Europe offers his insights.

There is no doubt that MiFID II will have a profound and lasting...

WaveLabs signs up its first hedge fund client

WaveLabs, developer of the specialist fixed income trading technology, eLiSA, has signed up its first hedge fund client.

The eLiSA execution management system (EMS), created...

The unspoken truth about US Treasuries

Susan Estes, co-founder, CEO & President at OpenDoor speaks to The DESK and exposes the hidden risks within the US Treasury market for institutional investors.

Dealer business...

Liontrust to acquire GAM

Liontrust, the specialist fund management group, has conditionally agreed to acquire GAM, the troubled investment management group, in an all share approach, with ordinary...

Analyst firm Aité in merger to form Aite-Novarica Group

Analyst firms Aité Group and Novarica have merged to create the an advisory firm focused on helping executives from banks, payments providers, insurers, securities...

A tale of two tapes: Consolidating the consolidators

Market participants will be hit with simultaneous, major technical demands in late 2025 and early 2026 as both the EU and UK update transparency...