BlackRock veteran Mitchelson to join Bloomberg

Multiple sources have confirmed that Rob Mitchelson, formerly Europe, Middle East, Africa (EMEA) head of fixed income and FX trading at BlackRock, is to...

TD Securities becomes LCH SwapAgent member

TD Securities is now live as a LCH SwapAgent member, the first Canadian bank member, bringing membership up to 44 from across 12 countries.

The...

ANZ finds no evidence of market manipulation in preliminary analysis

Investigations into ANZ’s Australian Markets business are ongoing, with preliminary analysis by the organisation finding no evidence of market manipulation.

The Australian Securities and Investments...

DTCC affirmation rates up for April – but investment managers lag

DTCC affirmed 83.5% of transactions by the DTC cutoff time – 9:00 PM ET on trade date – in April 2024, it has reported.

This...

Deutsche Bank launches new FIC coverage model

Deutsche Bank has set up a new coverage model for its fixed income and currencies (FIC) sales team, intended to be more tailored to...

Corporate bonds : How big is credit? : Joel Clark

STANDING ROOM ONLY FOR CREDIT PLATFORMS.

As corporate bond trading platforms do battle, the size of the prize is not clear. Joel Clark reports.

How much...

Rules & Ratings: Covered clearing agencies subject to new risk management rules

The SEC has amended rules related to the risk management and resilience of covered clearing agencies, introducing new requirements around intraday margin collection and...

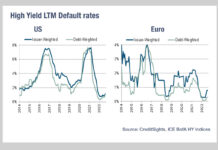

Less distressed debt

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

FIX Trading Community releases guidelines on commission unbundling

By Flora McFarlane.

A new report has set out practices to follow for pre- and post-trade representation of commission steps across all asset classes.

With under...

How is e-trading accelerating the momentum for global Emerging Markets?

Despite persistent macroeconomic challenges, EM bonds have achieved broad gains in 2024.

Traders are increasingly on the lookout for tools that can help them...

Meet the new market makers

The DESK profiles six of the major electronic liquidity providers.

Non-traditional market makers were seen to offer liquidity when many dealers pulled back in 2020....

Candriam promotes bond chief to CIO

Candriam, the global multi-asset manager has appointed Nicolas Forest, Candriam’s global head of fixed income since 2013, as its new chief investment officer (CIO),...