FILS US 2023: Traders need tech solutions that plug directly into their workflow

The View on Liquidity panel at FILS US 2023 had some stern words on the urgent need to integrate better protocols directly into workflows...

Teresa Durso joins Tabula Capital

Quantitative macro credit manager Tabula Capital has appointed Teresa Durso as managing director and chief operating officer.

Durso has close to two decades of industry...

Evolution through collaboration

MiFID II and electronification are transforming the credit market – How can one benefit from this new environment to access liquidity and how can...

European Women in Finance: Tricia Chan & Lucy Brown, MarketAxess

Staying one step ahead

Tricia Chan, Hong Kong Sales Manager, and Lucy Brown, ETF & Hedge Fund Sales at MarketAxess talk to Lynn Strongin Dodds...

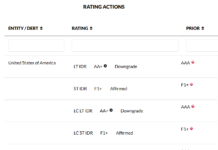

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...

Broadridge acquires Itiviti

Broadridge Financial Solutions has signed a definitive agreement to acquire Itiviti, the trading and connectivity technology provider to the capital markets industry, in an...

State of the market: Analysis of the platform landscape

Consolidation of the market continues, yet there are clear areas of growth in 2020.

In the corporate and government bond trading space for dealer-to-client trading, the...

Industry viewpoint : smartTrade : Benjamin Becar

Finding solutions

Benjamin Becar, Fixed Income Product Manager at smartTrade Technologies, speaks to The DESK about how technology is key to overcoming buy-side fixed income...

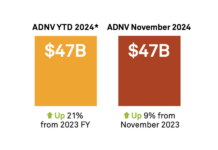

US corporate bond market continues upward trajectory

Average daily notional volumes (ADNV) were up 9% year-on-year (YoY) in US credit markets, reaching US$47 billion. Year-to-date, ADNV is up 21%.

In 2024, the...

The reward of risk

By Larry E. Fondren, Founder & CEO, DelphX Capital Markets Inc.

Traditional risk/reward comparisons treat the effective cost of an investment’s risk as a decrement...

European Women in Finance – Rebecca Healey – It’s not the destination but the...

Rebecca Healey talks to Lynn Strongin Dodds about Covid, Capital Markets and Career.

How do you see your role in the current crisis?

The initial question...

Nicholas Stephan joins Liquidnet’s fixed income team

Market operator Liquidnet, has appointed of Nicholas Stephan as global head of fixed income product, services and dealer relations. The appointment is the latest...