Port in a storm: Asian international bond markets resilient amid volatility

Volatile interest rates, a fractious geopolitical landscape, and rumbles in the Chinese property sector. Despite these headwinds, the international bond markets in Asia were...

Analysis: Market response to US Treasury’s increased borrowing needs

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...

Industry viewpoint: BNY Mellon’s Pershing Debuts BondWise

BNY Mellon’s Pershing announced the debut of BondWise, a fixed income research, management and trading tool available on its NetX360®+ platform.

There has been a...

ICMA proposes post-trade deferral regime for sovereign bonds

The international Capital Markets Association (ICMA) has proposed a deferral regime for post-trade sovereign bond data, to counter the ‘complicated’ approach currently allowed.

In...

Platforms: What the winners are doing right

A few platforms have consistently gained buy-side confidence over the last five years, through smart assistance and simplification of trading workflow.

The three ‘O’s of...

ICE consolidates access to ICE Bonds and ICE Data Services

Market operator Intercontinental Exchange (ICE), has launched ‘ICE Select’ an application which provides connectivity to the ICE Fixed Income ecosystem, including the ICE Bonds...

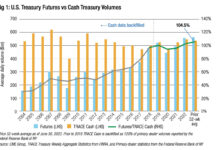

FILS in Barcelona: If the future is futures, what happens when the market is...

Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson...

Have US IG trades hit their smallest size this year?

The fires of summer are being replaced by the floods of autumn, but in the bond markets a gentler and more positive outcome is...

Neptune embeds Symphony chat functionality

Neptune Networks Ltd, the Fixed Income network for real-time “axe” indications, today announced that it has embedded Symphony chat functionality within the Neptune proprietary...

Trumid launches emerging markets trading

Fixed income market operator Trumid, has launched emerging markets bond trading on its Trumid Market Center platform.

Market Center connects fixed income professionals to a...

OpenYield opts for RBC Clearing & Custody

Bond marketplace OpenYield has joined the RBC Clearing & Custody platform, the first alternative trading system (ATS) to do so.

OpenYield, launched in 2022, provides...

7 Chord to integrate Glimpse Markets’ bond transaction data

7 Chord, an independent provider of predictive prices and analytics to fixed income traders, issuers, and investors, has become the first AI pricing vendor...