Analysis of US yields in 2021 and anticipation for next year

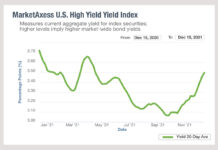

Yields for US high yield bonds have turned a corner, according to MarketAxess data, following a drop from 3.65% in April down to 3.065%...

LSEG extends Yield Book partnership for analytics with Citi

LSEG (London Stock Exchange Group) has announced an extension to its long-standing Yield Book analytics partnership with Citi.

Yield Book and Citi have a long...

TransFICC: The European bond market – changing by the microsecond

By Judd Gaddie, Co-Founder TransFICC

Advantages have always been sought by traders, often resulting in a race to obtain information before competitors. Incorporating new technology...

Candriam promotes bond chief to CIO

Candriam, the global multi-asset manager has appointed Nicolas Forest, Candriam’s global head of fixed income since 2013, as its new chief investment officer (CIO),...

Exclusive: New xBK head, Dragan Skoko, discusses BNY Mellon’s new outsourced trading

BNY Mellon has launched a new outsourced trading offering for buy-side institutions globally, including asset managers and asset owners.

The offering by BNY Mellon...

July 2023: Tradeweb sees total credit ADV jump 30% YoY in July driven by...

At Tradeweb, in July 2023, fully electronic US credit ADV was up 34.8% YoY to US$4.8 billion and European credit ADV was up 38.6%...

EWIFA Winner: Turning challenge into opportunity

Serene Murphy, Head of Corporate Development for Europe & Asia at Tradeweb, talks market structure, adaptability and innovation.

Can you please tell me what is...

Handelsbanken Fonder AB adopts Bloomberg’s PORT Enterprise

Handelsbanken Fonder AB, a subsidiary of Handelsbanken managing approximately 100 mutual funds, has adopted PORT Enterprise, Bloomberg’s portfolio and risk analytics solution, to further...

PIMCO tells IOSCO all-to-all trading needed for transparency

Emmanuel Roman, chief executive officer at PIMCO, has made a case for disintermediation / all-to-all trading being the only method to deliver transparency in...

The DESK’s Trading Intentions Survey 2021

This year sees tighter pipelines for new business and a wider array of trading protocols.

Executive summary

One year on from the sell-off in Q1 2020,...

Market data ‘Bill of rights’ opens discussion on transparency, accessibility and ownership

A week after the UK’s Financial Conduct Authority announced a consultation into buy-side access to data and benchmarks, bond pricing specialist BondCliQ and data...

Trumid collaborating with Jefferies in EM credit trading

Bond market operator, Trumid, is collaborating with Jefferies in emerging markets (EM) credit trading.

Jefferies will use Trumid’s Attributed Trading (AT) protocol and workflow solutions...