LedgerEdge: Building low- and high-touch trading in a mutually inclusive model

Tailoring workflows within a distributed environment will allow traders to simultaneously optimise electronic execution and relationship-based trading.

FILS Daily: What effect have the increasingly volatile...

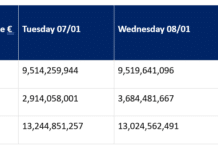

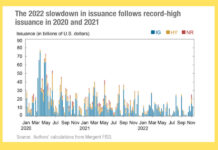

Liberty Street Economics asks: How Is the corporate bond market functioning as rates rise?

The Federal Reserve Bank of New York’s market structure and macro analysts, Liberty Street economics, has examined how corporate bond market functioning has withstood...

Schleifer: “Explosive growth” for desktop interoperability as Finsemble goes solo

Cosaic is spinning off its desktop interoperability platform, Finsemble, following the sale of its Chart IQ to S&P Global, as a new company. The...

Did UBS/CS deal terms just revalue the entire AT1 bond market?

Buy-side trading desks say they are looking at the risk of contagion across financials, following the takeover of troubled Credit Suisse by UBS, for...

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners and benefits.

Three firms have confirmed they will compete to be...

The reward of risk

By Larry E. Fondren, Founder & CEO, DelphX Capital Markets Inc.

Traditional risk/reward comparisons treat the effective cost of an investment’s risk as a decrement...

Chappell leaves Nordea IM as head of fixed income trading

Brett Chappell has left Nordea Investment Managers as head of fixed income trading, with his role being filled temporarily by Jakob Jessen, executive director...

Reimagining RFQ for Credit: The building blocks to a truly flexible approach

By Chioma Okoye, Managing Director, European Institutional Credit, Tradeweb

Innovation, automation and collaboration – the key to returning operational capacity back to the trader in order...

IHS Markit and CBPC open up China’s bond market with new onshore indices

By Shobha Prabhu-Naik.

Business information provider IHS Markit has launched new onshore Chinese bond market indices, which it claims are the first international, independent fixed...

S&P Global Ratings: European credit spreads still wide

In its latest ‘Europe Credit Markets Update’, S&P Global Ratings has painted a grim picture for European borrowers, notably in the high yield space,...

MarketAxess: bringing transparency to the muni marketplace with AI-powered pricing

Julien Alexandre, Global Head of Research and Daniel Kelly, Head of Municipal Securities at MarketAxess

CP+, our AI-powered algorithmic pricing engine for the global credit...

FCA warns on permissions needed for MiFID II

By Sobia Hamid.

Firms who need to change their regulatory permissions as a result of MiFID II, in effect from 3 January 2018, are advised...