Analysis: Impact of diverging capital rules and higher rates on banking

A new paper by analysts from Morgan Stanley and Oliver Wyman has identified two main drivers for change within wholesale banking over the next...

Liquidnet: Traders moving towards alpha capture

By Vineet Naik.

New research indicates that the role of the trader is shifting towards enhancing fund performance by not only the protection, but also...

Research: OMS/EMS Survey 2022

Traders prioritise O/EMS analytics as liquidity dries up

OMS/EMS stacks need to help traders assess trading conditions in 2022.

The DESK’s research into buy-side execution and...

Trading places – From bonds to fixed income ETFs

Phil Cichlar, Head of Fixed Income Sales & Trading at Jane Street shares his insight on the burgeoning ETF market.

Fixed income exchange-traded funds (ETFs)...

Fed breaks silence on HFT in treasuries

Having opened the US government debt market to high-frequency trading, authorities now push market participants to “be good citizens”. Dan Barnes reports.

The Federal Reserve...

Quorum 15 launches digital membership with Greenwich Associates

By Shobha Prabhu-Naik.

Quorum 15, a global financial markets think tank, has entered a new partnership venture with analyst firm Greenwich Associates, to support digital...

BlackRock launches first BuyWrite fixed income ETFs

BlackRock launched a first-of-its-kind suite of fixed income ETFs that provide access to buy-write investment strategies on baskets of fixed income securities: the iShares...

Regulation : Brokers warned on SI regime missteps : Dan Barnes

Regulators have expressed concern over banks’ plans for operating systematic internalisers (SIs) under the revised Markets in Financial Instruments Directive (MiFID II). Dealers have...

Overbond to integrate Euroclear LiquidityDrive into real-time bond trading automation

Overbond, the provider of AI quantitative analytics for institutional fixed income capital markets is to integrate Euroclear LiquidityDrive settlement-layer data for fixed income trade...

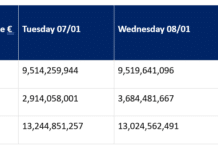

Mutual funds leveraging futures to increase portfolio risk and yield

US Treasury futures holdings among mutual funds have shot up over the last three years, as they adjust to a “higher for longer” interest...

How big is portfolio trading in corporate bond markets?

Recent reports from market participants have given slightly different estimates for the use of portfolio trading in US corporate bonds, however the consensus is...

BondbloX to offer US corporate, muni and Treasury bond liquidity

BondbloX Bond Exchange (BBX), the world’s first fractional bond exchange, has integrated with ICE Bonds to offer US corporate, municipal and treasury bond liquidity...