Stephen Hannaford swaps Alphadyne for Citadel

Citadel has appointed Stephen Hannaford as part of its fixed income and macro trading team.

Hannaford has more than a decade of industry experience and...

Hanneke Smits appointed CEO of BNY Mellon Investment Management

Hanneke Smits, CEO of BNY Mellon subsidiary Newton Investment Management, is to be appointed CEO of BNY Mellon Investment Management, following the retirement of...

William Dulude joins Clear Street, plus new management appointments

Clear Street, the prime broker and capital markets infrastructure provider has named William Dulude as chief product officer; Prerak Sanghvi as vice president of...

Markets Media acquires Trader TV to form multimedia capital markets giant

Global capital markets publisher, Markets Media Group, has acquired Trader TV, the leading online trading TV provider, to form a multi-media giant, spanning the...

ASEAN exchanges push for sustainability progress

Executives at ASEAN exchanges have agreed on four proof-of-concepts to follow over the next three years, continuing their sustainability initiatives.

The objectives, determined at the...

Is the price right?

Transparent assessment of bond prices is a cornerstone of trust between investment managers and end investors. Chris Hall investigates.

Pricing in fixed income markets is...

MarketAxess buys Deutsche Börse’s regulatory reporting business

Fixed income market operators and data provider, MarketAxess, has entered agreed to buy the Regulatory Reporting Hub, the regulatory reporting business of Deutsche Börse...

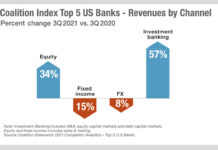

What banks’ primary success can tell us about their priorities in 2022

When looking at the revenues of investment banks in Q3 2021, using Greenwich Coalition data, we can see that secondary market trading in fixed...

J.P. Morgan: Finding the best path in e-trading fixed income

Electronic trading may resolve key structural challenges in the market for buy-side traders, including instrument selection, with guidance from key dealers.

Chinedum Nzelu, head of...

Bloomberg to buy Broadway Technology in boost to rates trading

Bloomberg has entered into an agreement to acquire Broadway Technology, a fixed-income execution management system (EMS) provider. This acquisition will help Bloomberg to...

Bloomberg, MarketAxess and Tradeweb Markets team up to tackle European consolidated tape

Bloomberg, MarketAxess and Tradeweb Markets today jointly issued the following statement:

“We are pleased to announce an initiative to jointly explore the delivery of a...

Coalition Greenwich: US Treasury e-trading volumes hit record in February

US Treasury volumes saw an average daily notional value (ADNV) of US$918 billion in February 2024, Coalition Greenwich’s March Data Spotlight has reported, up...