How a partnership led by innovation is helping benefit investors

Tradeweb and Generali Investments have worked carefully to engineer maximum change with minimal risk to better support the asset manager’s clients.

Enrico Bruni, head of Europe...

ICE: Size-Adjusted Pricing (SAP)

Shifting odd lot dynamics throw a spotlight on ICE’s Size-Adjusted Pricing

A dramatic jump in small trade volumes, driven by increased retail and electronic...

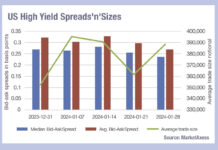

Get US high yield portfolios in order over summer

June looked decidedly challenging for US high yield (HY) trading, as mean bid-ask (BA) spreads dislocated from the median, indicating spikes in BA spreads...

Bond trading disrupted as ICSDs close to ruble settlement

International central securities depository (ICSD) Euroclear has announced it will no longer settle ruble-denominated transactions from 1 March 2022 until further notice.

The firms reported...

BNY Mellon adds agency MBS to new DTCC cleared repo sponsored member programme

US post-trade market infrastructure giant, the Depository Trust & Clearing Corporation (DTCC), has launched its Sponsored General Collateral (GC) Service, a new offering from...

Corporate bond trading platform LTX picks 7 Chord for intraday pricing

Broadridge Financial Solutions has selected 7 Chord, an independent predictive pricing and analytics provider, as the source for intraday corporate bond prices on its...

Smaller proportion of US Treasuries e-traded than previously estimated

Levels of e-trading in US treasuries in dealer-to-dealer (D2D) and dealer-to-client (D2C) markets have come into sharper focus thanks to data collected by FINRA...

New Enterprai workstation tracks market events for macro investment teams

Enterprai, a software-as-a-service (SaaS) workstation for global macro professionals, which uses predictive analytics for FX and fixed income markets, has launched a set of...

BNY goes live with Dublin EU trading desk

BNY has established a trading desk in Dublin, supporting EU-based clients across global fixed income and equity markets. Bianca Gould, head of EMEA equities...

Tighter spreads, bigger trades

Credit markets have largely seen tightening bid-ask spreads since the start of the year on both sides of the Atlantic – some segments more...

Marathon names Alex Howell as head of European alternative credit

Marathon Asset Management has named Alex Howell as a senior managing director and as head of European alternative credit. Howell has also joined the...

FMSB publishes final standard for the sharing of investor allocation information

The FICC Markets Standards Board (FMSB) has published the final standard for the sharing of investor allocation information in the fixed income primary markets.

Syndicate...