Groupama Asset Management and Amundi Intermediation merge desks

Groupama Asset Management has partnered with Amundi Intermediation, merging the two trading desks to support the development of its execution business.

The decision has been...

Trading : Intertwining electronic trading of credit and rates

Electronic market operators are bringing together credit and rates trading platforms in an effort to deliver more efficient execution for traders.

The interplay between the...

Research shows increasing demand for voice and e-trading data integration across TCA and surveillance

Demand for integrated trade and communications surveillance among financial institutions has surged by 100% this year following heightened regulatory scrutiny across the financial markets,...

The Autonomous Trader

Separating the trading function from portfolio management is a painful exercise, but the benefits can be felt by the end investor. Dan Barnes reports.

Buy-side...

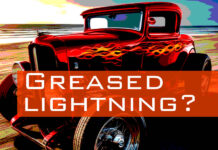

Systematic, hydromatic; can credit get as fast as greased lightning?

Some investment firms have claimed they can fully systematise credit trading by 2025, The DESK investigates.

Investment managers and banks are rapidly adopting systematic approaches...

The Book: BofA DCM team give issuers confidence for financing in 2025

The DESK spoke with Bank of America’s Julien Roman, head of EMEA DCM FIG Origination, Paula Weisshuber, head of EMEA Corporate DCM, and Adrien...

Angelo Proni named CEO of MTS

Angelo Proni has been CEO for bond market operator MTS, part fo Euronext. Taking over from Fabrizio Testa, who was named CEO of Borsa...

The liquidity gap between 144A and Reg S bonds

144A and Regulation S (Reg S) securities have distinct regulatory backgrounds and key differences. Liquidity measures such as Bid-Ask spread and post-issuance volumes in...

Middleton named global head of FI trading at Morgan Stanley IM

Dwayne Middleton has been promoted to global head of fixed income trading, nearly a decade into his career at Morgan Stanley Investment Management (MSIM)....

BoE amends collateral eligibility criteria for regulated covered bonds

The Bank of England is to amend the collateral eligibility criteria for regulated covered bonds in the Bank’s Sterling Monetary Framework.

From 1 September, to...

BGC reportedly shuts Lucera LUMEAlfa; preps FMX for soft launch

According to sources, BGC Partners has shuttered its pre-trade data business, Lucera LUMEAlfa, closing the final chapter on pre-trade data pioneer Algomi, and aligning...

Mapfre adopts Aladdin for execution, investment management

Mapfre AM, the asset management division of Spanish insurance company Mapfre which holds €57 billion in assets under management, has adopted BlackRock’s investment management...