Citi develops blockchain FX solution under Monetary Authority of Singapore Guardian project

Citi has developed an application that uses blockchain infrastructure to price and execute bilateral spot foreign-exchange (FX) trades.

The application is a part of Project...

Tapping the expanding universe of credit futures and options

Cboe has launched options on Cboe iBoxx iShares Corporate Bond Index futures, and widened its trading hours to further expand the user base and...

IPC and BondWave announce partnership to simplify pre-trade price discovery

IPC Systems, the communications and connectivity specialist has integrated its Unigy trade communications platform and IQ/Max Touch financial terminal with the BondWave Calculator, a...

InvestorAccess reaches milestone with 500th institutional investor on board

IHS Markit reports it has onboarded the 500th institutional investor to its buy-side InvestorAccess community, the firm’s digital primary market platform.

InvestorAccess first launched in...

UK pension fund clearing exemption gets long-term renewal

Following a November 2023 call for evidence, the UK government has decided to extend the exemption for pension funds to clear certain derivative contracts...

Charlie Collins named head of European credit at Trumid

Fixed income market veteran, Charlie Collins, has been named head of European credit at Trumid. Collins was most recently a managing director at Tradeweb,...

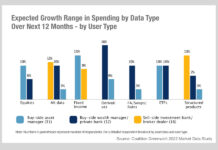

Coalition Greenwich: Buy-side data spend sees highest growth in fixed income

Spending is up across all categories of market data, with equities, fixed income and derivatives all expected to see a rise of more than...

John Johnson joins UBS Asset Management

UBS Asset Management has appointed John Johnson as an execution trader.

Based in Chicago, he reports to Theodore Drury, regional head of trading, Americas.

Johnson has...

ESMA reports improving credit risk but Overbond warns on liquidity risk

The European Securities and Markets Authority (ESMA) has released its latest ‘Trends, Risks and Vulnerabilities’ (TRV) report, finding that fixed income markets continued to...

Secondary volumes in 2021 outpace 2020 sell-off implying greater liquidity

The first quarter of 2021 saw record volume in US and European investment grade trading volume. This is surprising on several fronts, with significant...

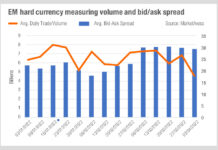

The cost of liquidity in EM today

A very graphic representation of the cost of liquidity can be seen in the latest data from MarketAxess. It shows that average daily volume...

MarketAxess reports record August volumes

Bond-market operator MarketAxess has reported having its strongest ever August monthly trading volumes, with US$30.6 billion in total trading average daily volume (ADV), up 44%, driven by...