Regulation & Market Structure: How the SEC and the Fed will change US bond...

Transparency and structure is coming to the US Treasury and credit markets.

The role of the Fed is changing and consequently the role of other...

US corporate bond market continues upward trajectory

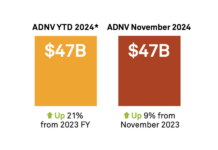

Average daily notional volumes (ADNV) were up 9% year-on-year (YoY) in US credit markets, reaching US$47 billion. Year-to-date, ADNV is up 21%.

In 2024, the...

European Women in Finance – Sukh Bachal – Finding her tribe in fintech

Shanny Basar speaks to Sukh Bachal about standing your ground, finding the right balance and lending a helping hand.

Sukh Bachal was recently promoted to...

Charles River Development to be acquired by State Street Corporation

Charles River Development, provider of the Charles River Investment Management Solution (IMS), will be acquired by State Street Corporation, a deal expected to be...

Brokertec data shifts to Bloomberg with Reuters/Dealerweb data tie-up

By Shobha Prabhu Naik & Dan Barnes.

Bloomberg, the financial data provider, has launched a new data service that will take NEX’s BrokerTec US Treasuries...

FILS USA 2022: How material will desktop Interoperability be for traders?

The rollout of FDC3 as a standard to support desktop interoperability between different applications has generated considerable interest in the trading community.

Dwayne Middleton, global...

Mizuho issues green bond in continued sustainability drive

Mizuho Financial Group has issued a €500 million green bond, part of its core business theme of sustainability and innovation.

Funds raised by the issuance...

European Women in Finance : Alexandra Boyle : Making a noise

Alexandra Boyle, Head of Client Strategic Group at OpenFin, speaks to Markets Media’s senior writer Shanny Basar about her career, her philosophy and her...

Python eats traders

By Chris Hall.

Balancing man and machine will be the critical success factor for buy-side trading desks, delegates were told in Thursday’s head trader keynote...

Obligation to clear could be delayed to 2019 for smaller derivatives users

For financial counterparties, and certain funds classified as non-financial counterparties, whose individual aggregate positions in over-the-counter (OTC) derivatives are €8 billion or below, the...

Emerging markets’ big issues in 2022

According to analysis by CreditSights, there has been a negative total return for credit in emerging markets with the exception of Gulf Cooperation Council...

Redburn sees value in bond market venue M&A

Analysis by broker Redburn has found that major exchanges – in which it included MarketAxess, the fixed income trading venue, and interdealer broker TP...