Study finds 21% of buy-side lost access to tradable instruments in crisis

A new ‘Derivatives Insight Report’ by analyst firm Acuiti has found that 21% of buy-side firms, including proprietary trading firms and asset managers, suffered...

Derivatives Forum Frankfurt: Efficiency drives towards multi-asset trading

One of the primary reasons for the adoption of multi-asset trading is to improve efficiency, agreed ‘Trends in Multi-asset Trading’ panellists at this year’s...

Fixed income fees normalising at JP Morgan

JP Morgan’s fixed income revenues in the fourth quarter of this year are expected to be 10% lower than the record final quarter of...

EU begins NGEU bill auctions but secondary market needs support

The European Union’s new bond issuance auction programme started on 15 September, via the TELSAT auction system operated by Banque de France for its...

PIMCO tells IOSCO all-to-all trading needed for transparency

Emmanuel Roman, chief executive officer at PIMCO, has made a case for disintermediation / all-to-all trading being the only method to deliver transparency in...

Direct streaming builds support at TradeTech

The evolution of bond trading, through the smart application of technology and increasingly sophisticated market making is promising to deliver better execution, said Lynn...

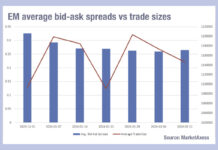

Emerging markets trading costs threaten to rise

Emerging market bond traders will see trading costs rising as volumes begin to decline. According to MarketAxess data from its CP+ pricing tool and...

DTCC affirmation rates up for April – but investment managers lag

DTCC affirmed 83.5% of transactions by the DTC cutoff time – 9:00 PM ET on trade date – in April 2024, it has reported.

This...

Update: How big is portfolio trading?

In November 2020, we assessed the prevailing research on the size of portfolio trading in the corporate bond market. A new report from Coalition...

ESMA clarifies CTP exclusion criteria documents

ESMA has clarified the documents that firms bidding to be consolidated tape providers (CTP) must provide during the application process.

In the first stage of...

Brokertec data shifts to Bloomberg with Reuters/Dealerweb data tie-up

By Shobha Prabhu Naik & Dan Barnes.

Bloomberg, the financial data provider, has launched a new data service that will take NEX’s BrokerTec US Treasuries...

Dealers grow FICC revenues 15% in first quarter of 2021

Sell-side fixed income, currency and commodities (FICC) revenues saw growth of 15% in the first quarter of 2021, according to new research by analyst...