Adroit: Fixed income EMSs must reach beyond trading venues

Adroit Trading Technologies has raised US$15 million in a Series A round led by Centana Growth Partners. The cash will be spent on expanding...

Bank of England maintains stock levels of government and corporate bonds

By Flora McFarlane.

The Bank of England’s Monetary Policy Committee (MPC) has voted to maintain the stock of government bond purchases at £435 billion and...

Hedge fund AI vehicle wins investment from Nomura

By Vineet Naik.

Nomura, the investment bank, has announced that it is investing in AIM2, a venture specialising in creating artificial intelligence (AI) solutions for...

Middleton named global head of FI trading at Morgan Stanley IM

Dwayne Middleton has been promoted to global head of fixed income trading, nearly a decade into his career at Morgan Stanley Investment Management (MSIM)....

SGX CDP live with Marketnode DLT direct-to-depository service for bond issuers

Singapore Exchange’s Central Depository (SGX CDP) has made a blockchain-enabled bond issuance platform available to market participants. Developed by Marketnode, an SGX Group-Temasek digital...

US credit issuance tailing off over summer?

June 2024 has seen US corporate bond issuance levels only slightly higher than those seen in June 2023, after record levels at the start...

The utopia of the consolidated fixed income tape

Lynn Strongin Dodds explains why Europe cannot look to TRACE as a role model.

Developing a consolidated tape for fixed income in Europe was never going...

European Women in Finance: Tricia Chan & Lucy Brown, MarketAxess

Staying one step ahead

Tricia Chan, Hong Kong Sales Manager, and Lucy Brown, ETF & Hedge Fund Sales at MarketAxess talk to Lynn Strongin Dodds...

Quarterly European fixed income market analysis

Leveraging Trax’s vast market data set, the Trax Facts quarterly review provides a detailed analysis of activity across fixed income markets, including: Corporates, Agencies,...

Citi clears CDS index option trades through ICE Clear Credit

Investment bank Citi has traded and cleared the first client-executed credit default swap (CDS) index option trades in the US through ICE Clear Credit,...

Buy-side firms may dominate front office tech

Buy-side firms need to make secular decisions about whether to buy or sell technology to other asset managers. Dan Barnes reports.

In April, CEO of...

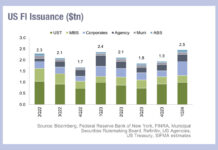

Shielding from exploding issuance

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase...