Primary markets : Discretion is the better part of bond issuance

The US regulator has raised questions over bank control of new issuance automation – the question is whether banks behave with valour.

A recent report...

The $21.6 trillion question: How many regulators does it take to change a lightbulb?

The US$21.6 trillion US Treasury market is confounded by a lack of transparency and very short-term liquidity provision, according to a new joint staff...

Volcker repeal plans challenged

Ditching the Volcker Rule would have a limited effect on liquidity, but the enthusiasm for change exists. David Wigan writes.

The Volcker Rule has been...

EM stabilising could encourage market makers

Emerging market activity has seen a reduction in volatility in the first half of the year, with both volumes and pricing levels falling slightly,...

FILS in Barcelona: ‘Spectre at the feast’ as recession looming despite falling inflation

At FILS 2023, Amir Fergani head of fixed income France & EMEA at Generali Insurance Asset Management, Philippe Waechter, chief economist at Ostrum Asset...

LSEG FY 2023 results: Fixed income offsets wider capital markets drop

London Stock Exchange Group (LSEG) reported its full year (FY) 2023 results today, with earnings in line with expectations despite a slight drop in...

FILS 2022: FlexTrade, Glimpse herald “transformative” EMS data integration

Bond market data sharing platform Glimpse Markets has integrated with FlexTrade Systems’ fixed income execution management system (EMS), the two companies have announced.

FlexTrade said...

Editorial: Oversight of US bond markets is broken

Oversight of the US bond markets is broken. The world’s sixth largest bank by assets, JP Morgan, was able to manipulate the US Treasury...

Bloomberg introduces new fixed income pre-trade TCA model

Bloomberg has launched a new pre-trade transaction cost analysis (TCA) model that helps market participants to assess trade cost, daily executable volume, and probability...

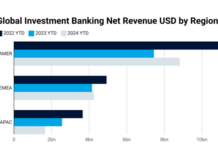

Analysis: Impact of debt issuance on sell-side revenues in Q1

Strong bond issuance in the first quarter (Q1) is galvanising performance of debt capital market teams at investment banks, in turn creating optimism amongst...

Viewpoint : The impact of technology : Mike du Plessis & Mark Goodman

AI angst: keeping up with the robots

By Mike du Plessis, Managing Director, Global Head FX, Rates and Credit Execution Services and Mark Goodman, Managing...

Tradeweb processes first electronic iBoxx standardised total return swap trade

Fixed income market operator Tradeweb has completed the first-ever fully electronic standardized total return swap trade based on IHS Markit’s iBoxx USD Liquid High...