Port in a storm: Asian international bond markets resilient amid volatility

Volatile interest rates, a fractious geopolitical landscape, and rumbles in the Chinese property sector. Despite these headwinds, the international bond markets in Asia were...

Beyond Liquidity: Investors Turn to Fixed Income Dark Trading During Market Stress

Dark pool trading in credit markets offers numerous benefits on a day-to-day basis, and can increase during periods of market stress. A recent example...

MeTheMoneyShow – Episode 11

In this week’s discussions Dan Barnes and John D'Antona focus on potential changes at the SEC and how the resurgence of retail trading has...

Dagmar Kamber Borens takes on new role at State Street

State Street has appointed Dagmar Kamber Borens as head of global markets for continental Europe at State Street Bank International.

Based in Zurich, she reports...

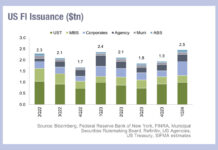

Analysis: Market response to US Treasury’s increased borrowing needs

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...

Daniel Swaby rejoins Liquidnet

Daniel Swaby has returned to Liquidnet as a sell-side trader.

Swaby has almost 15 years of industry experience, most recently serving as a director at...

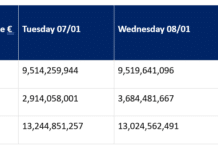

TS Imagine reports growth in volumes and user base for fixed income

TS Imagine, the cross-asset provider of trading, portfolio, and risk management systems reports it has seen average notional volume increase sevenfold in its TradeSmart...

Shielding from exploding issuance

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase...

FILS USA 2023: Fed has lost investors’ confidence in guidance

The Federal Reserve’s constant mistakes on forward guidance have lost the confidence of some buy-side firms in its ability to predict outlooks.

Speaking at...

Pimco says Fed’s new repo facility should ease future stress

Asset manager Pimco said the US Federal Reserve’s creation of a permanent standing repo facility (SRF) will help develop more resilient funding markets, although...

Credit Market Structure Alliance conference fights to bypass commercial debate

Now in its second year, the CMSA conference fights for the right to maintain integrity on stage.

ViableMkts is hosting the next installment of the...

Buy side wants new tools in primary market tsunami

Several buy-side traders report new primary bond market tools could come online this year in the US, with dealer consortium DirectBooks expected to step...