Market reflects grim situation in Ukraine

The invasion of Ukraine on 24 February 2022 by Russia, wedded to subsequent sanctions and travel restrictions have triggered a series of market responses...

Trumid promotes Mike Sobel to co-CEO

Bond market operator Trumid, has named Mike Sobel as co-CEO alongside founder and co-CEO Ronnie Mateo. A founding member of Trumid’s team, Sobel will...

Refinitiv puts Tick History data on Google Cloud

Refinitiv has launched its Tick History dataset on Google Cloud Platform (GCP), letting customers access, query and analyse Refinitiv’s extensive archive of pricing and...

Trumid partners with Barclays

Bond market operator, Trumid Financial, has established a strategic partnership with Barclays. Barclays will join Trumid’s Trading Advisory Committee to collaborate on trading and...

LedgerEdge: Building low- and high-touch trading in a mutually inclusive model

Tailoring workflows within a distributed environment will allow traders to simultaneously optimise electronic execution and relationship-based trading.

FILS Daily: What effect have the increasingly volatile...

EC to review mandatory buy-in rules under CSDR

The European Commission has stated that it will review the mandatory buy-in rules under the Central Securities Depository Regime (CSDR). The comments were made...

TISE sees bond listings bump thanks to rosy macro picture

The International Stock Exchange (TISE) listed 444 securities during the first half of 2024, an 18.4% increase against the same period last year.

The total...

Viewpoint: What an institutional trader needs to know about FI ETFs and futures

Where instrument selection can be key, understanding cash and derivatives instruments and the interplay between them is invaluable.

The DESK spoke with Joyce Choi, director...

Lead : Crossing trades & best execution : Dan Barnes

The best ways to cross‑trade

Crossing trades between funds is operationally complex but rewarding for investors and asset managers; using platforms to standardise the process...

Broadridge partners with MultiLynq to accelerate connectivity

Corporate bond trading firm LTX, a subsidiary of Broadridge Financial Solutions, has integrated with MultiLynq to accelerate connectivity to its platform.

MultiLynq provides liquidity and...

ISIN at issuance launched for Eurobonds by Origin

Origin Markets, the debt capital markets fintech, is launching an instant-ISIN feature, created in collaboration with international central securities depositary (ICSD) Clearstream, which is...

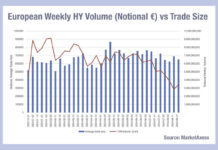

The effect of trade sizes on high yield liquidity costs

Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to...