IMTC: Customising investment products efficiently in a rising rate environment

Technology is enabling investment managers to automate portfolio and instrument selection putting clients in the driving seat.

The DESK interviewed Russell Feldman, CEO of IMTC,...

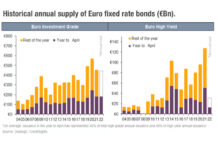

Withering supply of European high yield

Comparing the ‘year-to-April’ data across years, 2022’s high yield issuance looks more like the post-financial crisis period than most years in between.

Data from CreditSights...

MarketAxess: Portfolio Trading for Tax-Exempt Munis is now live

Portfolio Trading for Tax-Exempt Munis is here!

Optimize your list trading for large or customized portfolios. With the ability to negotiate on individual line...

CME Group completes migration of BrokerTec trading platform to CME Globex

Market operator CME Group has migrated the US Treasuries trading and US repo functions of BrokerTec business to its CME Globex platform. This follows...

State Street introduces buy-side to buy-side repo programme

State Street has launched a new peer-to-peer repo programme for the buy side. Building out from its sponsored repo and securities lending model, including...

Insights & Analysis: “Lock in attractive yields as easing cycle continues,” UBS advises

Trump’s election saw Treasury yields rise sharply but stabilise by the end of the week, with the VIX index dropping to its lowest since...

Tradeweb and MarketAxess see credit volumes increase over 25% in December

Market operators MarketAxess and Tradeweb have released their December trading levels, with both seeing a monthly increase of 25% in credit trading average daily...

Senior fixed income trader joins Bloomberg’s primary markets team

Keenan Choy, formerly a primary markets fixed income trader with Wellington Asset Management in the US, has been active in developing primary market processes...

Coalition: FICC up 50% for banks in H1, rates revenues doubled

Banks saw fixed income, currency and commodities (FICC) revenues rise by 54.6% in the first half of the year according to analyst firm Coalition....

Tradeweb files for IPO

Market operator Tradeweb Markets, has filed a registration statement on Form S-1 with the Securities and Exchange Commission (SEC) for a proposed initial public...

Trading Intentions Survey 2017

The range of credit liquidity aggregation platforms used has increased, reducing demand for new connections.

About the survey

The DESK’s Trading Intentions Survey is global primary research...

Month-end activity in alternative protocols

By Misha Girshfeld, Research Specialist and Grant Lowensohn, Senior Research Analyst at MarketAxess. 25 October, 2022

Highlights

We have seen an average increase of about 11%...