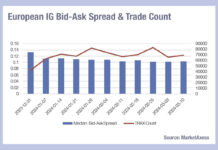

European investment grade seeing smaller, cheaper trades

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s...

Citadel Securities FICC systematic trading head Mark Wilkinson departs firm

Citadel Securities’ head of FICC systematic trading Mark Wilkinson is to depart the firm.

According to a social media post, Wilkinson had his last day...

New Aité report provides detailed analysis of fixed income EMS capabilities

A new report from the Aité Group, penned by Audrey Blater and Matt Simon, has provided an in-depth look at the execution management system...

The Agency Broker Hub: An Italian story

The Italian Treasury has implemented a flexible and diversified funding policy to manage the amount of Italian public debt. Here Laura Maridati, Digital Markets...

MarketAxess launches direct access to UBS Bond Port

Users of MarketAxess’ private banking and wealth management service Axess IQ can now route orders directly to UBS Bond Port.

“UBS has been a liquidity...

Broadridge’s LTX platform launches buy-side advisory group

To further help develop corporate bond trading and advance market structure, Broadridge Financial Solutions has formed a new Buy-Side Advisory Group for LTX, Broadridge's...

DirectBooks launches platform for issuance of US corporate bonds; European expansion on cards

DirectBooks, the sell-side consortium founded to increase efficiency in the bond issuance process, has launched its core service to try and simplify communication of...

ASEAN exchanges push for sustainability progress

Executives at ASEAN exchanges have agreed on four proof-of-concepts to follow over the next three years, continuing their sustainability initiatives.

The objectives, determined at the...

Charles River using Finsemble to expand third-party application integration

Charles River Development, the State Street owned order and investment management system (O/IMS), is collaborating with Cosaic, to use the latter’s Finsemble platform to...

BNY goes live with Dublin EU trading desk

BNY has established a trading desk in Dublin, supporting EU-based clients across global fixed income and equity markets. Bianca Gould, head of EMEA equities...

TransFICC: The European bond market – changing by the microsecond

By Judd Gaddie, Co-Founder TransFICC

Advantages have always been sought by traders, often resulting in a race to obtain information before competitors. Incorporating new technology...

Greenwich Associates: Fixed-income future shaky for dealers

By Flora McFarlane.

Analyst firm Greenwich Associate’s report on investment banks trading European fixed income, has indicated that the first half of 2017’s buoyancy on...