TransFICC: The European bond market – changing by the microsecond

By Judd Gaddie, Co-Founder TransFICC

Advantages have always been sought by traders, often resulting in a race to obtain information before competitors. Incorporating new technology...

Insights: US policy shift could reduce central bank cuts

Trump’s inward-oriented US policies will drive a rise in inflation, put upward pressure on interest rates and prevent central banks from making aggressive cuts,...

Morgan Stanley: Fed buying programme has benefits beyond direct purchases

Analysis of the Federal Reserve’s Secondary Market Corporate Credit Facility (SMCCF) by Morgan Stanley analysts has found that its purchases of exchange traded funds...

Technology: Can the EMS become a desktop trading venue?

Direct streaming of dealer prices could allow traders to bypass third party venues, if their desktop systems can be used to execute direct streams...

Viewpoint: Knowing the boundaries

Interview with Tim Whipman, head of business development at TransFICC

In February this year ESMA published its Opinion on the Trading Venue Perimeter, which provides...

BoE’s limited window could punish the gilt-y

The Bank of England’s limited UK government bond (gilt) purchase operations have been confirmed to close on Friday, putting tight brackets around buy-side firms’...

LedgerEdge: Building low- and high-touch trading in a mutually inclusive model

Tailoring workflows within a distributed environment will allow traders to simultaneously optimise electronic execution and relationship-based trading.

FILS Daily: What effect have the increasingly volatile...

The UK’s PRA cites break from EU in review of capital rules for buy...

The Prudential Regulation Authority (PRA), the UK’s prudential authority for financial services, has begun reform of capital rules for insurers and banks, in its...

Carney condemns fragmentation of CCPs

By Flora McFarlane.

In his annual Mansion House speech on 20 June, Mark Carney argued against breaking up trading infrastructure, after the recent European Commission’s...

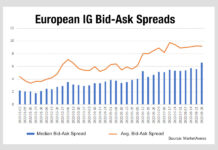

Why are European IG Bid-Ask spreads widening?

Liquidity in the European corporate bond market is becoming more expensive in both high yield (HY) and investment grade (IG) trading. According to MarketAxess...

BBVA shares Sabadell merger proposal

BBVA has shared details of its merger proposal with Sabadell, a partnership that would see the consolidation of two of Spain’s biggest banks.

The proposal...

Morningstar analysis shows fixed income funds under the cosh with thin liquidity

According to a new report from market data specialist, Morningstar, the unprecedented interest-rate hikes across developed markets has left most bond categories deep in...