BMO expands etrading for Institutions and broker dealers to EMEA

BMO Financial Group has expanded its electronic trading footprint in Europe, Middle East, and Africa (EMEA), launching its electronic trading services for institutions and...

The Gensler Agenda

Will Gary Gensler, chair of the Securities and Exchange Commission (SEC), one of the US market regulators, have time to tackle issues in the...

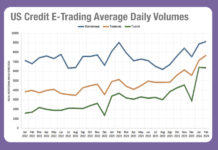

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

Best practice in credit TCA measures

The need to optimise execution quality is increased as buy-side firms seek to optimise all-to-all trading, and therefore price making, in credit. Transaction cost...

BondWave’s fixed income engine integrates with ICE Bonds

BondWave, the fixed income system provider, has successfully integrated its Effi Markets tool with the ICE Bonds’ trading platforms.

Effi Markets provides access to indicative...

Viewpoint: Why bond traders are changing their habits

Informed traders are discovering that newer approaches to executing trades are more successful than older, habitual paths.

The DESK spoke with Max Callaghan of MarketAxess...

Goldman Sachs agrees to buy NNIP for €1.6 billion

Goldman Sachs has agreed to buy European asset manager NN Investment Partners from NN Group NV for €1.6bn, marking the biggest acquisition under CEO...

MarketAxess and S&P Global Market Intelligence partner on FI data

S&P Global Market Intelligence and MarketAxess have begun a fixed income data partnership, aiming to improve market transparency and efficiency. Integration between the two...

TORA integrates Neptune to boost fixed income OEMS

Trading technology provider, TORA, is integrating its leading order/execution management system (OEMS) with Neptune Networks, the pre-trade data connectivity source. The new connection enables...

Sourcing and connecting: The buy-side fixed income liquidity challenge

By Frank Cerveny, Head of Markets and Sales at MTS.

How can institutional investors find the liquidity to grow their fixed income businesses with the...

BondCliQ users get MTS BondsPro data for US credit market

MTS Markets International, part of London Stock Exchange Group (LSEG), and BondCliQ, a new corporate bond market data solution, have partnered to provide BondCliQ...

The Book: Clearstream’s D7 hits €10 billion in digital issuances

Clearstream’s digital securities platform, D7, has reached €10 billion in issuance volumes. The firm reports that the service completes up to 15,000 new digital...