MeTheMoneyShow – Episode 22

Dan Barnes speaks with Lynn Strongin Dodds about some old chestnuts - a consolidated tape for European equities, and the implications of Brexit for...

Charlie Enright joins Symetra

Charlie Enright has joined insurance and retirement specialist, Symetra, as a credit trader.

Enright spent nearly seven years at Genworth, a similarly focused buy-side firm,...

Chart of the week: Attack of the killer BBBs

The lowest tier of investment grade bonds show an interesting opportunity in the new issue space, as observed by analyst firm CreditSights. Relative value...

Tradeweb processes first electronic iBoxx standardised total return swap trade

Fixed income market operator Tradeweb has completed the first-ever fully electronic standardized total return swap trade based on IHS Markit’s iBoxx USD Liquid High...

KNG Securities appoints Cristian Fera as LatAm corporate analyst

Fixed income investment bank KNG Securities has appointed Cristian Fera as LatAm corporate analyst.

At KNG, Fera will focus on international debt issued by Latin...

StoneX launches loan market liquidity platform

StoneX Group has launched StoneX LoanMatch, an online platform designed to improve liquidity access for institutional clients and banks in the loan market.

The platform...

Rutter launches ambitious new bond ‘ecosystem’, LedgerEdge

David Rutter, founder of US Treasury platform LiquidityEdge and CEO of distributed ledger group R3, has built a team of financial market and technology...

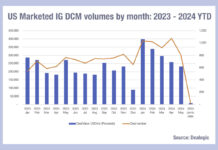

High Yield issuance is taking off

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...

Scotiabank, Rabo Securities and Huntington Capital Markets join DirectBooks

DirectBooks, the capital markets consortium founded to optimise the bond issuance process has signed up Scotiabank, Rabo Securities and Huntington Capital Markets to join...

Parameta and ICAP launch interest rate swap volatility indices

Parameta Solutions, in partnership with ICAP G10 Rates, has launched a family of interest rate swap volatility indices designed to enhance the investment decision...

‘Whatsapp’ fines for banks hit US$1.8 billion

US market regulators have collectively fined 15 broker-dealers, one affiliated investment adviser, plus the swap dealer and futures commission merchant (FCM) affiliates of 11...

Swedish broker shut for pushing risky bonds and illicit issuer payments

Swedish market regulator, Finansinspektionen (FI), has revoked all permits for Nord Fondkommission AB (Nord FK) to continue trading.

Nord FK is a securities firm whose...