Analysis: BNP Paribas / AXA IM merger as French AMs roll up

The BNP Paribas Group has entered into exclusive negotiations with AXA to acquire 100% of AXA Investment Managers (AXA IM), representing close to €850...

Bloomberg, MarketAxess and Tradeweb sign joint venture agreement

Bloomberg, MarketAxess and Tradeweb have signed a joint venture agreement, to establish an independent company for the purpose of participating in the public procurement...

Neptune priced at £16k a year for buy side

Neptune, the dealer axe and inventory messaging platform for corporate bonds, began to charge buy-side traders a flat annual rate of £16,000 a year...

Flow Traders: Algos supported 20% of bond flows in 2022

A new white paper from exchange traded fund (ETF) market maker, Flow Traders, estimates that in the past two to three years, credit algos...

ICMA: Adopt data-driven approach to MIFIR RTS 2 post-trade deferral framework

The International Capital Market Association (ICMA) has co-signed a cross-industry statement on the MIFIR RTS 2 post-trade deferral framework for bonds, calling for a...

Eurex expands FX Futures offering to emerging markets currencies

Eurex will start trading new FX Futures contracts covering Brazilian Real (BRL), Mexican Pesos (MXN) and South African Rand (ZAR) on 10 October 2022....

Dom Holland joins LedgerEdge

LedgerEdge, the distributed ledger ecosystem for corporate bond trading, has appointed senior fixed income specialist Dom Holland to the role of business development for...

Have US IG trades hit their smallest size this year?

The fires of summer are being replaced by the floods of autumn, but in the bond markets a gentler and more positive outcome is...

Neptune adds MUFG to its network

By Flora McFarlane.

Neptune has announced that MUFG (Mitsubishi UFJ Financial Group) is the latest bank to join its fixed income network, bringing the total number...

Liane Fahey joins Tradeweb

Former fixed income trader, Liane Fahey, has joined market operator Tradeweb, from Royal London Asset Management.

In her new role as European credit product...

Regulation : Brokers warned on SI regime missteps : Dan Barnes

Regulators have expressed concern over banks’ plans for operating systematic internalisers (SIs) under the revised Markets in Financial Instruments Directive (MiFID II). Dealers have...

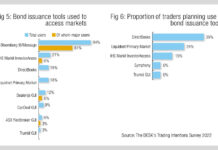

Will primary market tools fragment new issuance instead of standardising it?

Research by The DESK has found that buy-side traders have adopted a range of primary market tools to help them increase their efficiency at...