MeTheMoneyShow : Cryptic problems for US regulators

In this podcast Dan Barnes speaks with Terry Flanagan and asks whether Europe is leading the race for exchange traded products? They discuss the...

On The DESK: Divide and conquer

The DESK interviews the team delivering continuous management of trading, for the world’s largest collective assets under management.

• Dan Veiner is Co-Head of Global...

IRD traders see room for improvement in dealer technology use

Close to a third of interest-rate derivatives (IRD) traders are content with the technology use of their dealers, according to a recent Coalition Greenwich...

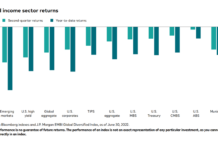

Emerging Markets Focus Part 1: What the flows mean for traders

Fixed income sector investments have proven worst for emerging markets funds year to date, according to data from JP Morgan and Bloomberg indices, driving...

Analysis: BNP Paribas / AXA IM merger as French AMs roll up

The BNP Paribas Group has entered into exclusive negotiations with AXA to acquire 100% of AXA Investment Managers (AXA IM), representing close to €850...

Jamie Crank promoted at ASX

ASX has appointed Jamie Crank as group executive for technology and data, effective 9th September.

The appointment follows “an extensive external and internal search process”,...

SEC forms Fixed Income Market Structure Advisory Committee

By Flora McFarlane.

The Securities and Exchange Commission (SEC) has announced the formation and first members of its Fixed Income Market Structure Advisory Committee.

The committee,...

Algomi ALFA adds actionable liquidity via Liquidnet and Trumid

Algomi ALFA has taken a step closer to becoming a smart order router (SOR) for fixed income, by enabling actionable liquidity alerts for the...

Coalition Greenwich: Return on investment now viable for fixed income EMS

Dated fixed income markets are set to undergo a rapid technological transformation. But it is from a low bar, with fixed income 10 to...

TS Imagine and IHS Markit partner in European fixed income data

TS Imagine, the cloud-based multi-asset order and execution management system (OEMS) provider and IHS Markit have partnered to allow the OEMS TradeSmart platform, in...

LedgerEdge selects Exactpro to support distributed ledger enabled corporate bond trading

Exactpro, a software testing provider for mission-critical financial market infrastructures, has been chosen by LedgerEdge, which is developing a next-generation ecosystem for corporate bond...

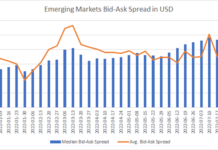

Emerging Markets Focus Part 2: Illiquidity in numbers

When investment flows are heavily directional it can make trading more challenging, as most investment firms are selling into a downward market or buying...