Regulation : Brokers warned on SI regime missteps : Dan Barnes

Regulators have expressed concern over banks’ plans for operating systematic internalisers (SIs) under the revised Markets in Financial Instruments Directive (MiFID II). Dealers have...

On the DESK : Vincenzo Vedda : DWS

Heading into a stormy 2019, traders need both confidence and evidence to achieve their goals.

What do you think a bond trader in 2018 needs...

Citi invests in Cicada to boost institutional e-Trading of Mexican govies

Citi has made a minority investment in Cicada Technologies in order to boost the electronification of the US$500 billion Mexican fixed income market. Citi...

Illiquidity creeps up in US credit… will e-trading save the day?

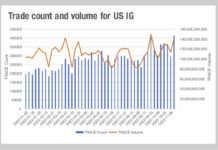

Looking at data on US credit markets, taken from MarketAxess Trax, which tracks trading across multiple markets and counterparties, investment grade trading volumes have been...

When, not if: ‘UK should move to T+1’

The UK should commit to move to a T+1 settlement cycle. That is according to the UK’s Accelerated Settlement Taskforce, which recommends setting up...

MeTheMoneyShow – Episode 15

This week, Dan Barnes speaks with Global Trading's Shanny Basar about fixed income ETFs. In these uncertain times, why are they proving so popular (in...

Industry viewpoint: AiEX opens new chapter for trading in APAC

Laurent Ischi, Head of APAC Automation, Tradeweb

When it comes to the increased adoption of electronic trading in interest rate swaps and other derivatives products,...

FILS 2021: Next steps to automating the bond market

Data analysis, interoperability and flexibility are the top priorities for automating the bond markets, delegates at the 2021 Fixed Income Leaders Summit (FILS) in...

ICE sees $35 billion in AUM switched to its indices during H1 2021

Market and infrastructure operator Intercontinental Exchange has reported strong growth in its index business in the first half of 2021. This was driven by...

Nomura Securities hit with special entitlements suspension

Nomura Securities has had its Special Entitlements of JGB Market Special Participants (Primary Dealer) suspended for a month as part of actions against unlawful...

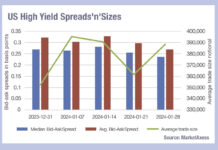

Tighter spreads, bigger trades

Credit markets have largely seen tightening bid-ask spreads since the start of the year on both sides of the Atlantic – some segments more...

Uncertainty on impact of US debt ceiling

Members of the Treasury Market Practices Group (TPMG) were unable to come to a consensus on the impact of the US debt limit being...