How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...

Wall Street 2022: bonuses fell 26%

Wall Street’s 2022 average bonus paid to securities employees dropped to $176,700, a 26% decline from the previous year’s $240,400, according to New York...

Global Data Happens at ICE

Across global markets, data underpins every decision. At ICE, we provide quality data and analytics across global asset classes and at every stage of...

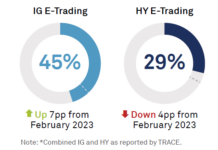

Coalition Greenwich: Electronic bond trading rises in US IG, declines in high yield

The use of electronic trading in corporate bonds will continue to increase, Coalition Greenwich’s March Data Spotlight has stated.

Electronic trading activity grew faster than...

The Agency Broker Hub | An open gateway into financial markets

By Gherardo Lenti Capoduri, Head of Market Hub, and Barbara Valbuzzi, CFA, Head of Market Strategy, IMI CIB Division, Intesa Sanpaolo.

In recent years the sellside...

Advances in corporate bond e-trading: Five lessons learned

By Constantinos Antoniades, Global Head of Fixed Income at Liquidnet

Since early 2015 we have seen a steady acceleration in the migration towards electronic trading...

Greenwich: Nearly half of bond trading desk budgets now spent on technology

New research by Coalition Greenwich has found that the proportion of budget for fixed income trading desks spent on technology grew to 46% in...

US Fixed Income Leaders Summit delayed

The Fixed Income Leaders Summit in Nashville which had been planned to take place in June 2020, has been postponed in light of the...

Office of Financial Research: Treasury basis trades could pose systemic risk

A new paper from the Office of Financial Research (OFR) has cast doubt on the idea that basis trades increased the lack of liquidity...

Vive la revolution!

Securing the benefits of the markets’ democratic revolution.

By Mike du Plessis, Managing Director, Global Head FX, Rates and Credit Execution Services and Mark Goodman,...

Insights & Analysis: “Lock in attractive yields as easing cycle continues,” UBS advises

Trump’s election saw Treasury yields rise sharply but stabilise by the end of the week, with the VIX index dropping to its lowest since...

March sell-off has driven a longer-term shift towards all-to-all trading

Buyers and sellers were successfully finding opportunities in all-to-all trading as traditional liquidity tightened. Does that herald a permanent shift in behaviour?

All-to-all trading came...