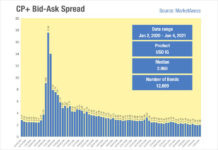

Sub-2bps bid-ask spreads in US IG are below pre-crisis levels

The US investment grade (IG) credit market is seeing very tight bid-ask spreads in 2021, according to the Composite Plus (CP+) data supplied by...

Liquidnet releases future rolls workflow service

Liquidnet has launched Roll Seeker, a tool to improve workflows associated with the execution of futures rolls.

Roll Seeker will enable the bilateral negotiation of...

On the DESK : Vincenzo Vedda : DWS

Heading into a stormy 2019, traders need both confidence and evidence to achieve their goals.

What do you think a bond trader in 2018 needs...

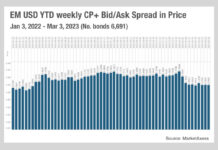

Emerging markets’ uneasy calm

Bid-ask spreads for fixed income trading in emerging markets have stabilised after a tumultuous year in 2022, according to TraX data, triggered by the...

Market reflects grim situation in Ukraine

The invasion of Ukraine on 24 February 2022 by Russia, wedded to subsequent sanctions and travel restrictions have triggered a series of market responses...

Teamwork makes the dream work: Traders can add alpha

There is room for improvement in the relationships between portfolio managers and traders, and without taking advantage of their potential funds could miss out...

Germany’s rates market comfort

Germany’s government bond market is in rude health, according to the latest analysis of sovereign debt by Andy Hill, director at the International Capital...

MarketAxess volumes up 16.4%; EM and all-to-all lead growth

By Pia Hecher.

Venue operator and data provider MarketAxess has announced its second quarter results with significant upward trends in overall trading volume, including Open...

Video interview with Rhian Ravenscroft

Rhian Ravenscroft, Senior Legal Counsel at MarketAxess is asked about her race to the top by Markets Media's, senior writer Shanny Basar.

European Women in Finance...

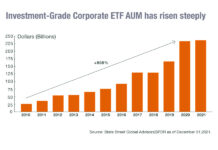

Credit Indices – Closing the Fixed Income Evolutionary Gap

Fixed income markets are evolving at pace, with smarter electronic trading protocols, more sophisticated, automated investment strategies and a greater availability of useful data.

In...

Morgan Stanley to acquire Eaton Vance

Morgan Stanley is to buy investment manager Eaton Vance, which has US$500 billion in assets under management (AUM), for US$7 billion. The acquisition should...

When banks go bust holding boring bonds

**This article will appear in full in the next issue of The DESK**

Government bonds are described as a 'risk-free' instrument, on the basis that...