How Omicron has shaken trading desks

Investors and analysts are urging a cautious response to the new Covid variant – Omicron – after Friday’s markets saw the Volatility Index (VIX)...

Balancing short and long term liquidity provision

Best execution on a trade-by-trade basis is too simplistic a measure of liquidity provision; The DESK looks at best practice for longer term liquidity...

Concannon joins MarketAxess from CBOE; New US exchange to fight incumbents

Bond venue operator and data provider MarketAxess has named Chris Concannon, as president and chief operating officer, effective as of January 22, 2019.

He will...

ICE ties BondPoint into broader fixed income strategy

By Flora McFarlane.

Intercontinental Exchange has completed its acquisition of BondPoint from Virtu Financial, signalling its continued expansion in the fixed income market.

BondPoint, an alternative...

Tradeweb steps into primary markets battle with InvestorAccess connection

Multi-asset market operator Tradeweb is collaborating with S&P Global Market Intelligence to introduce electronic connectivity between primary and secondary markets. The product scope currently...

Finbourne responds to closure of Bloomberg, MarketAxess & Tradeweb consolidated tape project

Finbourne, the financial technology and services firm selected to manage the now defunct joint project between Bloomberg, MarketAxess and Tradeweb to launch a consolidated...

Overbond and IPC partner on voice-to-AI supporting bond trading automation

Overbond has partnered with IPC, the communications and cloud connectivity service provider, to integrate IPC’s point-of-trade voice transaction data into Overbond’s artificial intelligence (AI)...

The DESK’s Trading Intentions Survey 2020 : Streamed dealer prices

STREAMED DEALER PRICES.

Streaming prices from dealers provide a key perspective on the market, but unless they are executable they have limited value for trading....

On The DESK: Chris Perryman: Boxing clever through emerging markets

Chris Perryman combines the brains to integrate quant strategies with the brawn of strong relationships ensuring PineBridge delivers best execution for investors.

Biography: Chris Perryman...

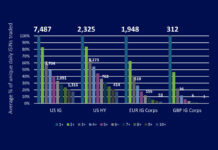

Comparing Corporate Bond Liquidity Across Regions

By Grant Lowensohn and Hidde Verholt.

Highlights

The US corporate bond market offers a significantly greater number of ISINs with high daily trade counts than other...

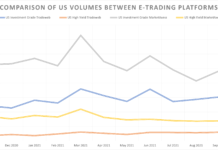

November sees e-trading volumes up

The 2020 pandemic marked a critical turning point for electronic trading in the corporate bond markets according to Tradeweb in the firm’s 2021 letter...

US Treasuries market picks up the electronic pace due to Covid-19

Covid-19 has triggered a “dramatic” shift in US Treasuries, the world’s largest bond market towards electronic execution from traditional voice trading, according to a...