Buy side hails positive development of STP for bond issuance

Risk warning lights flashing on buy-side trading desks could be assuaged thanks to industry collaboration on primary markets.

It seems incongruous that the 50-year old...

Nomura pushes regional growth, hires Zorzoli

Nomura has named Filippo Zorzoli as EMEA head of global market sales.

Based in London, Zorzoli reports to Nat Tyce, EMEA head of global markets...

Shah joins new fixed income team at Premier Miton Investors

Anish Shah has been named senior fixed income dealer at Premier Miton Investors, formed from the merger of Premier Asset Management Group and Miton...

Nicolas Pilorget promoted at Ontario Teachers’ Pension Plan

Ontario Teachers’ Pension Plan (OTPP) has appointed Nicolas Pilorget as head of credit trading. He is based in Toronto.

Pilorget has been with the company...

The $21.6 trillion question: How many regulators does it take to change a lightbulb?

The US$21.6 trillion US Treasury market is confounded by a lack of transparency and very short-term liquidity provision, according to a new joint staff...

Buy-side desks swing extra US$2.1 million into fixed income trading technology

By Sobia Hamid.

On average buy-side fixed income desks pushed US$2.1 million of additional budget into technology in 2016, according to new research from analyst...

Red, consolidated, tape

Traders want Europe to improve the quality of fixed income data, and quickly. Gill Wadsworth reports.

In October UK consultant Market Structure Partners was awarded...

BGC confirms FMX launch date of 23 September

BGC Group has confirmed that its FMX Futures Exchange will launch on 23 September, just one week from today.

The US interest rate futures exchange...

Connecting the primary and secondary credit workflows

With issuance at near record highs in the first week of the year, credit market traders are keen to make more effective use of...

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

US Credit: Liquidity costs trending down

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading...

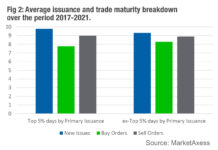

New issuance drives up secondary selling

News that high yield (HY) issuance has fallen in Europe may be of little consolation to investment grade investors, as new data from MarketAxess...