FILS in Barcelona: If the future is futures, what happens when the market is...

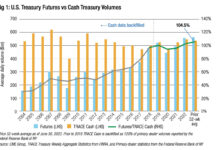

Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson...

Coalition Greenwich: Top market structure trends for 2023

“We are about to see how changes in global market structure and regulation that started to play out in 2022 will impact markets in...

Samantha Cooper named head of fixed income portfolio management at AllianceBernstein

Samantha Cooper has started a new position as head of the fixed income portfolio management group at AllianceBernstein.

Cooper, who has been with the firm...

Pre-trade data demand grows and platform concentration weakens

The 5th Annual Trading Intentions Survey sees a hunger for data and a surge in new liquidity tools.

Key takeaways:

• Massive growth for crossing / mid-point...

FCA and IOSCO publish LIBOR cessation reminders

Both the Financial Conduct Authority (FCA) and the International Organisation of Securities Commissions (IOSCO) have published reminders of the LIBOR cessation date, 30 September...

China Minsheng Bank taps Bloomberg for sell-side solutions suite

China Minsheng, a Chinese commercial bank, has adopted Bloomberg’s sell-side execution management solution ETOMS, and expanded its use of Trade Order Management Solutions (TOMS)...

Reviewing 2022: European credit trading costs have doubled

There have been an enormous number of factors shaking up bond trading this year. From fixed income fundamentals like rapidly rising interest rates from...

BoE amends collateral eligibility criteria for regulated covered bonds

The Bank of England is to amend the collateral eligibility criteria for regulated covered bonds in the Bank’s Sterling Monetary Framework.

From 1 September, to...

Trading Intentions Survey 2016 : The DESK

Building on data gathered in our 2015 Trading Intention’s Survey, The DESK presents its findings for 2016.

The respondents.

This year we had 70 responses from...

MiFID II: An exercise in risk management

Gherardo Lenti Capoduri, head of Banca IMI’s Market Hub, speaks with The DESK about the capacity of firms on both sides of the street...

European Women in Finance – Rebecca Healey – It’s not the destination but the...

Rebecca Healey talks to Lynn Strongin Dodds about Covid, Capital Markets and Career.

How do you see your role in the current crisis?

The initial question...

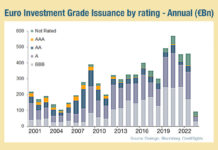

Europe’s record IG credit issuance could boost electronic trading

January was a record month for investment grade bond issuance in Europe, with shorter-dated driving this activity. According to analyst firm CreditSights, shorter maturity...