FILS 2021: Overbond adds pre-trade streaming API for TCA into EMS automation suite

Overbond, a provider of AI analytics and trade automation for the global fixed income markets, has added pre-trade and post-trade transaction cost analysis (TCA)...

ASX loses AUS$250 million on failed blockchain settlement project

The Australian Stock Exchange (ASX) has pulled its project to replace its existing settlement system, CHESS, with a blockchain-based settlement system.

The project, which has...

FILS 2024: “The key to delivering innovation”

Collaboration between humans and technology, between humans, and across businesses is essential to strengthening and developing fixed income markets in Europe, panellists at this...

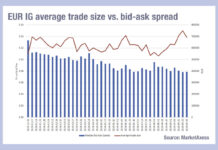

Is European credit electronification bouncing back?

There has been a noted proportional increase in electronification of US credit trading, as tracked by Coalition Greenwich. However, metrics around European trading found...

Bosworth Monck joins Aeon Investments advisory board

Credit-focused investment manager Aeon Investments has appointed Bosworth Monck to its advisory board.

Monck has more than three decades of industry experience, most recently spending...

Deutsche Börse invests US$10 million in Trumid

By Flora McFarlane.

Deutsche Börse Group has announced a “strategic investment and partnership” with New-York based Trumid, a company that provides an electronic trading network...

Bond funds inflows close Q1 2024 at 20 year highs

Bond funds saw record inflows in Q1 2024, according to EFAMA’s International Quarterly Statistical Release, reaching their highest levels since 2004.

Bond funds inflows were...

Quantitative Brokers: Rate futures market susceptible to shocks

A new paper by Quantitative Brokers’ research team, led by Shankar Narayanan has found that the average quote size of many interest rate futures...

TradingScreen integrates Bondcliq data

TradingScreen, the order and execution management system (OEMS) provider, has partnered and integrated with TradingScreen,, the corporate bond market system. The integration of BondCliQ’s...

US vs Europe: The transatlantic divide for corporate bond traders

The DESK examines the different sizes, protocols and feedback traders can use on each side of the Atlantic to execute corporate bond orders.

While US...

7 Chord on Geopolitical Risk in Bond Prices

7 Chord promises to change the way AI pricing reacts and adapts to sudden geopolitical events and their aftermath.

The DESK spoke with Kristina Fan, CEO of 7 Chord,...

Trading: Loans and ABS: The fixed income markets time forgot

Trading in the less liquid parts of the fixed income market has remained relatively untouched by electronification.

Loans and securitised products backed by loans can...