Chaucer: Cost of insurance against defaults on sovereign debt jumps by 102%

The cost of insuring against sovereign debt defaults has increased by an average of 102% over the past year, according to research by global...

Kempen chooses SimCorp Coric for legacy client reporting

By Flora McFarlane.

Dutch asset manager, Kempen, has selected SimCorp Coric for its reporting solutions, replacing its legacy reporting technology, in response to increasing regulation...

Danmarks Nationalbank now centrally clears repos at Eurex

Danmarks Nationalbank is now actively trading and centrally clearing repo transactions at derivatives market operator Eurex, which cites the onboarding of the first Nordic...

SEC forms Fixed Income Market Structure Advisory Committee

By Flora McFarlane.

The Securities and Exchange Commission (SEC) has announced the formation and first members of its Fixed Income Market Structure Advisory Committee.

The committee,...

Bond market operators see high yield down in Q3 2023 YoY with emerging markets...

MarketAxess saw its US high-yield average daily volumes (ADV) for Q3 2023 drop 20.4% against Q3 2022, standing at US$1.3 billion, while high-grade ADV...

Investor Demand: Long-term fixed income allocations rise as risk appetite remains neutral

State Street Holdings Indicators have shown that long-term investor allocations to fixed income rose 43bps to 27.9%, by extension meaning cash holdings dropped 80bps...

The data puzzle

Umberto Menconi, head of Digital Markets Structure, Market Hub at Banca IMI outlines the impact of regulation and the importance of data in a...

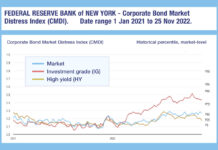

Substantially higher US investment grade stress going into 2023

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as...

Credit: The liquid, green bond sea

By Dan Barnes.

Green bonds issuance is booming and investor appetite growing, making access to markets increasingly important.

The size of the green bond market reached...

ICMA fills in the blanks on MiFID II agreement

A new article written by the regulatory team at the International Capital Markets Association (ICMA), has shed light on details in the agreed text...

Disruption without interruption

David Parker, Head of MTS Markets International (MMI) discusses tapping into the benefits of fixed income trading technology.

Technological advancements are quietly – and sometimes...

Mitsubishi HC Capital UK raises €60m on TreasurySpring with first sustainable fixed-term fund

Mitsubishi HC Capital UK, a provider of consumer lending, asset finance and vehicle leasing, has borrowed more than €60 million on TreasurySpring’s platform by...