EBA publishes market risk and transaction determination standards

The European Banking Authority’s (EBA) has published the final draft regulatory technical standards (RTS) on how to identify the main risk driver and determine...

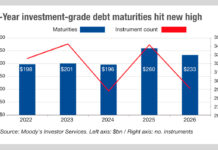

Trouble ahead for traders as number of issued bonds climbs

According to data from Moody’s Investor Services, the US investment-grade companies should have few problems refunding their debt in 2022, which is useful given...

On the DESK : Cathy Gibson : Royal London

The buy side must be an active participant in shaping market structure if investors are to achieve the best returns, says Cathy Gibson.

Biography: Cathy...

Tradition takes over BondsPro as MTS leaves US market

MTS, the European bond trading platform majority-owned by Euronext, has completed the sale of its US subsidiary MTS Markets International to Tradition America Holdings,...

Deciphering the Size of the Portfolio Trading Market: Ted Husveth

Ted Husveth, Managing Director, Credit Product Manager, Tradeweb.

In our last blog post, we examined what a typical portfolio trade on our platform looks like...

SEC’s proposals create competitive opportunities

Responses to the wide ranging proposals posited by the Securities and Exchange Commission (SEC) in US equity markets last week have raised questions but...

Goldman veteran joins Bank of America

Bank of America has appointed Simona Composto as director of futures and options, over-the-counter clearing, FX prime brokerage and fixed income prime brokerage sales....

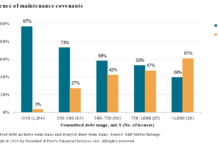

Origination: Switching between private and public markets

The use of private versus public borrowing by corporations has changed during 2024, based on falling funding costs in public and the capacity to...

Graham Capital appoints Jens Foehrenbach as president and co-CIO

Graham Capital Management, a hedge fund specialising in quantitative and discretionary macro strategies, has appointed Jens Foehrenbach as president and co-chief investment officer (co-CIO).

Foehrenbach...

Liquidnet adds trading in the South African bond market

Block and agency trading specialist Liquidnet, a TP ICAP company, is partnering with TP ICAP South Africa to support bond trading.

The firm reports...

Local currency emerging market trading grows at MarketAxess

MarketAxess, the operator of an electronic trading platform for fixed-income securities, has seen a rise in volumes of local currency bond trading in emerging...

Rules and Ratings: Moody’s sees improving credit fundamentals driving leveraged finance deals

As interest rates decline, credit fundamentals will improve in 2025 and defaults will ease, according to analysis from credit rating agency Moody’s.

“Investors will hunt...