Systematic credit trading changes the buy/sell-side dynamic

An investment manager capable of making a price in less than a minute in Europe, or several minutes in the US, can be a...

Exclusive: Spencer Lee joins TS Imagine as chief markets officer; sets out strategy

TS Imagine, the trading, portfolio, and risk management system provider, has announced Spencer Lee is joining as chief markets officer, to lead the firm’s...

FILS 2022: Market endures despite liquidity squeeze; strong dollar remains safe haven

The macroeconomic fallout of Russia’s invasion of Ukraine will continue to constrict liquidity for Europe’s fixed income markets and dictate central bank monetary policy...

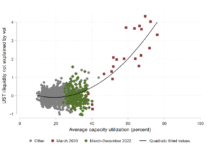

ICMA: Fully-automatic credit trading has grown; block liquidity has reduced

The International Capital Markets Association has found 44% of buy-side trading desks have increased their use of rules-based, fully automated electronic execution compared with...

US credit e-trading race tightens, November volumes fall

US credit e-trading volumes dipped for both MarketAxess and Tradeweb in November, the gap between the two platforms narrowing towards the end of the...

LSEG: Helping traders construct a single view of the market

Trading desks can customise their technology thanks to greater data democratisation and desktop interoperability, making trade analysis more effective than ever. This will allow...

Tradeweb announces JSCC clearing for MTF and SEF Yen swaps

Multi-asset market operator, Tradeweb has reported that institutional clients executing Japanese Yen swaps on its multilateral trading facilities (MTFs) and swap execution facilities (SEFs)...

Long running CMA investigation concludes with 4 banks fined £100m

The Competition and Markets Authority (CMA) has completed its investigation into anti‐competitive information exchanges in the UK government bond market, no names or details...

Luke Lau promoted at Northwestern Mutual

Northwestern Mutual has promoted Luke Lau to a portfolio manager for long duration IG corporate bonds.

Based in Illinois, Lau has more than 25 years...

CMA: ION takeover of Broadway looks likely

The UK’s Competition and Market’s Authority (CMA) has reported there are “reasonable grounds for believing that the undertakings offered by ION, or a...

What’s all the fuss about… the US Treasury market?

Who is kicking up a fuss about US government bonds?

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux...

Corporate bond trading platform LTX picks 7 Chord for intraday pricing

Broadridge Financial Solutions has selected 7 Chord, an independent predictive pricing and analytics provider, as the source for intraday corporate bond prices on its...