Credit trades’ double-figure yearly growth proves liquidity dividend

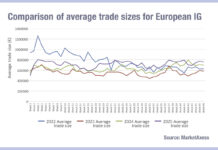

The gradual growth in trade sizes for European corporate bond trades is made clear in the latest MarketAxess TraX data comparison for data from...

Purva Patel swaps Nuveen for First Eagle

Independent, privately owned investment management firm First Eagle Investments has appointed Purva Patel as managing director and senior investment specialist of the high yield...

Data analytics is nothing without the people who use it

We are in the midst of a data analytics and artificial intelligence (AI) hype cycle. Every week yields a crop of new articles on...

The summer lull barely touches emerging markets

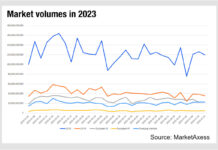

Trading volumes in fixed income markets typically start the year high and gradually fall, matching issuance and refinancing patterns along with investment allocation decisions....

Technology : Order management systems : Dan Barnes

Will buy-side firms build the OMS they need?

Complaints about order management system performance still dog the fixed income markets, increasing the likelihood of in-house...

Bond market growth slumped in 2018

By Pia Hecher.

Intercontinental Exchange (ICE) Data Indices, the information provider, has reported that the total outstanding debt across global bond markets only grew by...

Chart of the week: Attack of the killer BBBs

The lowest tier of investment grade bonds show an interesting opportunity in the new issue space, as observed by analyst firm CreditSights. Relative value...

Market sources: Project Amber has shut down

Multiple sources have confirmed that the withdrawal of major banks from Project Amber has shut it down. Three banks had reportedly left before the...

Joeri Wouters joins Tradeweb; firm launches ‘trade-at-close’ for portfolio trading

Joeri Wouters has been named product development manager within the AiEx and workflow solutions team of market operator Tradeweb, after 15 years as a...

BondCliQ US corporate bond data added to IOWArocks data marketplace

IOWArocks, the marketplace for data, tech, and services, has added BondCliQ to its IOWAdata marketplace. BondCliQ will offer its US corporate bond pre- and...

Market awaits CT news amid cross-Channel delays

Market participants have been asking for a bond consolidated tape for years; and they’re going to have to wait a little longer than planned,...

Rathbone Funds adopts Charles River IMS and State Street Alpha Data Platform

Rathbone Funds, the London-based subsidiary of Rathbones Group, has selected the Charles River Investment Management Solution (IMS) to support their equity, fixed income and...