Alison Hollingshead joins Jupiter AM

Alison Hollingshead has joined Jupiter Asset Management as chief operating officer for investment management.

“I am delighted to be starting my new role as COO,...

Internal crossing for US bond trading needs ‘principles-based’ approach

Buy-side firms have roundly supported Securities and Exchange Commission (SEC) proposals to allow internal crossing of fixed income trades in the US market, however...

ESMA corrects SI bond ranking to place BNP Paribas as second in Europe

The European Securities and Markets Authority (ESMA) has republished its ESMA Annual Statistical Report, now stating that the largest systematic internalisers (SIs) for bond...

AXA IM: Credit downgrades increases concentration and liquidity risk in index investment

A decrease in the average credit quality of fixed income indices and intensifying competition for high quality assets present increasingly serious challenges for UK...

Analysis: BNP Paribas / AXA IM merger as French AMs roll up

The BNP Paribas Group has entered into exclusive negotiations with AXA to acquire 100% of AXA Investment Managers (AXA IM), representing close to €850...

SEC creates unit to tackle emerging risks

The Securities and Exchange Commission has created the Event and Emerging Risks Examination Team (EERT) in the Office of Compliance Inspections and Examinations (OCIE)....

Transficc partners with Quinsol for their pricing engine

Quinsol Software, a startup innovator in fixed-income trading solutions, has announced a strategic partnership with TransFICC.

This collaboration aims to integrate Quinsol's Bond Price Hub...

SEC requests comment on evolution of buy-side internal crossing rules

The US Securities and Exchange Commission’s Division of Investment Management Staff has published a statement to elicit feedback on ways to enhance its regulatory...

SS&C connects with Trumid to expand access to corporate bond liquidity

Order management system (OMS) provider SS&C Technologies has connected with bond market operator Trumid, so its clients can trade US and emerging market (EM)...

Adaptive Auto-X creates choice in trade automation

Developing automation to suit a range of market environments has put MarketAxess’s clients ahead in the drive for more efficient trade execution and adaptable...

On The DESK: Sharon Ruffles

Sharon Ruffles, head of fixed income trading, EMEA at State Street Global Advisors, outlines her ongoing strategy to expand the scale, capabilities and reach of her team.

Which...

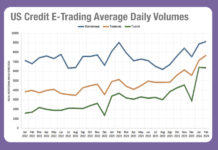

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...